This preference is supported by the history of Arzan VC investments: out of the 47 investments we made in the last 10 years, 49% were startups with two founders.

Looking at Pre-Seed deals concluded last year, I’m exploring whether the same trend holds.

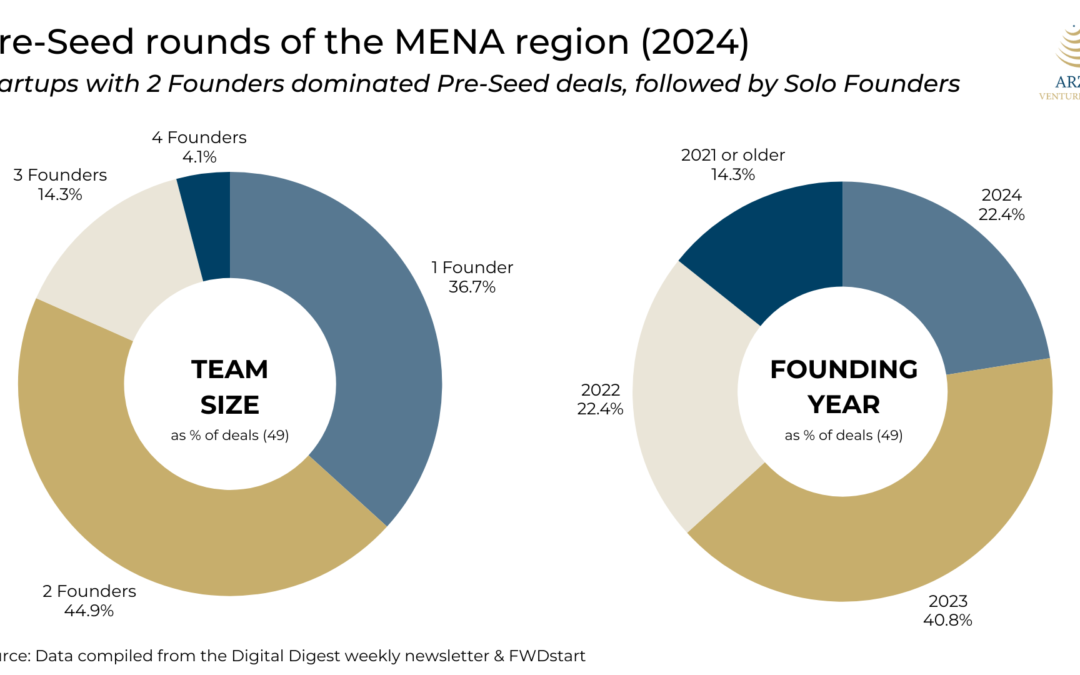

In 2024, two-founder startups dominated the Pre-Seed landscape, constituting 45% of all startups in terms of deal count. However, when it comes to capital allocation, two-founder startups did not lead the pack.

67% of last year’s Pre-Seed money went to solo founders

Solo-founded startups (with and without VC funding) became more common in the US in the last 10 years; they doubled to 35% of all startups formed on Carta in 2024.

But, according to Carta’s Founder Ownership Report 2025, VCs continue to prefer funding startups with 2 founders (34%) and 3 founders (25%) over a solo founder (note: US data only).

Is it the story similar for the Middle Eastern founders?

If you’ve come across a general database that tracks the creation of startups on a yearly basis, I’m all ears.

Many deals are announced without a “stage label,” so to keep things simple and effective, my focus today is solely on Pre-Seed deals announced in the media last year. I want to analyze which founding team size was most prevalent and whether it aligns with Carta’s findings for 2024.

One more accurate approach would be to focus only on startups founded in 2024 that received some form of VC funding in the same year. However, I expect that process to involve a lot of missing data, as those startups typically have a limited online presence.

Let’s see the findings.

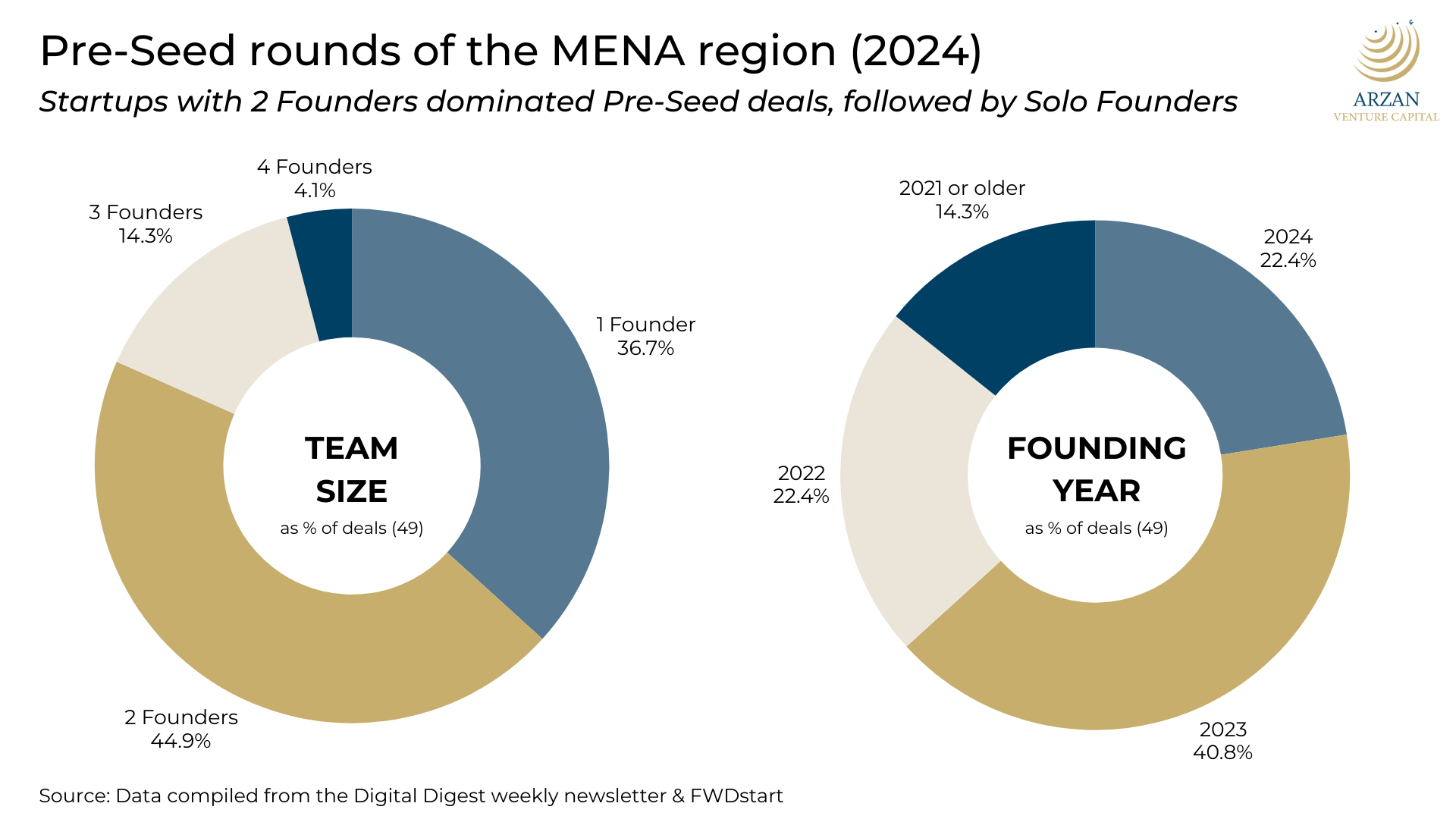

The region witnessed 50 Pre-Seed rounds in 2024, of which 39 were fully documented. (11 had either undisclosed values, or were described as “six figures” or “seven figures” or they have no online footprint so no further info.)

Funding surpassed $83 million.

In terms of deal count: 2-founder startups dominated the Pre-Seed landscape last year and they represented 45% of all startups. This supports Carta’s findings.

Here’s today’s second-biggest surprise: solo-founder startups surpassed 3-founder teams. 37% of all startups that raised a Pre-Seed round last year were led by solo founders—18 startups in total.

However… How about the capital allocations?

Let’s consider the fully disclosed 39 deals. Solo founders raised $55.8 million, representing 67% of the overall allocation to Pre-Seed in 2024. The “culprit”: Tumodo, a B2B travel platform founded in 2022 by Vladimir Kokorin, secured $35 million. 2-founder startups raised $17 million (20%), while $8 million (10%) went to 3-founder startups.

The 5 largest Pre-Seed deals of last year were: Tumodo (UAE), Mala (KSA), Bokra (EGY), Madfu (KSA) and Octa (UAE). The last 4 are fintechs.

Founding year analysis: Although startups founded in 2024 became more prevalent across the headlines starting Q2 2024, majority of startups that closed a Pre-Seed round last year were established in 2023. About 14% were founded in 2021 or earlier, including one startup as far back as 2017.

While screening, I also took note of the founders’ gender and, of course, ticket sizes (available for 40 deals). See below.

Tumodo’s $35 million round is an anomaly, with the next largest ticket at $7 million. The average ticket size drops to ~$1,240,000 when we exclude Tumodo.

As for the founder gender breakdown, there are no surprises here. Startups founded by males bagged at least $77 million in Pre-Seed funding, representing 43 deals. Mixed-gender startups raised $4.6 million.

Thoughts:

We can conclude that, yes, 2-founder teams had the most success in raising Pre-Seed in 2024. While Carta didn’t disclose the breakdown in terms of capital allocation, my gut feeling is that solo founders didn’t come out on top unlike their MENA counterparts.

The appeal of larger teams over solo founders seems obvious: startups with 2 or more founders remain more stable, even if one co-founder decides to leave. They can share responsibilities and lighten the workload (though I doubt their stress levels are reduced). Multiple founders can be compared to a springboard, fostering better idea-brainstorming and decision-making. Fundraising can also become easier.

The fact that most $ was raised by solo founders signals a contrarian trend in our local VC ecosystem. Are these solo founders solo by choice? While it’s true that a solo founder won’t have arguments with co-founders and their startup vision won’t be easily jeopardized, I’m pretty sure that during negotiations with the existing founder, participating investors would have voiced their preference for adding a co-founder in the near future. This requirement is likely already outlined in black and white.

Out of the 47 investments that Arzan VC made in the last 10 years, 23 were startups with 2 founders (49%), 5 of which had mixed-gender founding teams. In comparison, we invested in 12 startups with 3 founders (26%).

So, in a nutshell, we prefer startups with at least 2 founders, ideally a tech/non-tech mix. But this is a world of exceptions and that’s why we did end up investing in some amazing solo founders – 11 of them in total! cc Zeid Husban, Abdullah AlDayel, Sara Chemmaa, Ahmed Wadi, Ahmad Fuad AlObaid

Let’s see what the team size of our next investee will be ^^

|

TL;DR (too long; didn’t read)

Carta says that VCs continue to prefer funding startups with 2 founders over teams of any other size. Is it the story similar for the Middle Eastern founders? More than $83 million was allocated to Pre-Seed deals in MENA in 2024 and 2-founder startups dominated the landscape in 2024, constituting 44.9% of all deals. But in terms of funding allocation, solo founders came out on top, amassing $55.8 million thanks to Tumodo’s $35 million round.

|

Merit raised $28 million in Series B and unveiled a new logo

Swvl brings private placement to $6.7 million

Hulexo won the Sharjah Entrepreneurship Festival pitch competition!

TruKKer recognized as Annual Vendor of the Year

Mastercard prepaid card by Money Fellows (+ Banque Misr)

Visa card by Lucky ONE

Gameball explains the concept of loyalty

- Product Manager – App Marketplace & Developer Experience at Zid (Riyadh)

- Product Manager at Hala (Riyadh)

- AML CTF officer at Hala (Riyadh)

- Scrum Master at Hala (Riyadh)

- SW Quality Engineer at Hala (Riyadh)

- Sr Treasury Specialist at Money Fellows (Cairo)

- Financial Analyst at Money Fellows (Cairo)

- Sr Site Reliability Engineer at Qoyod (Egypt, remote)

- Staff SW Engineer at Qoyod (Egypt, remote)

- Financial Planning and Analysis Specialist at TruKKer (Dubai)

- Implementation Engineer at Gameball (remote)

- Sr Implementation Engineer at Gameball (remote)

مبارك عليكم الشهر

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2025 Arzan VC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list