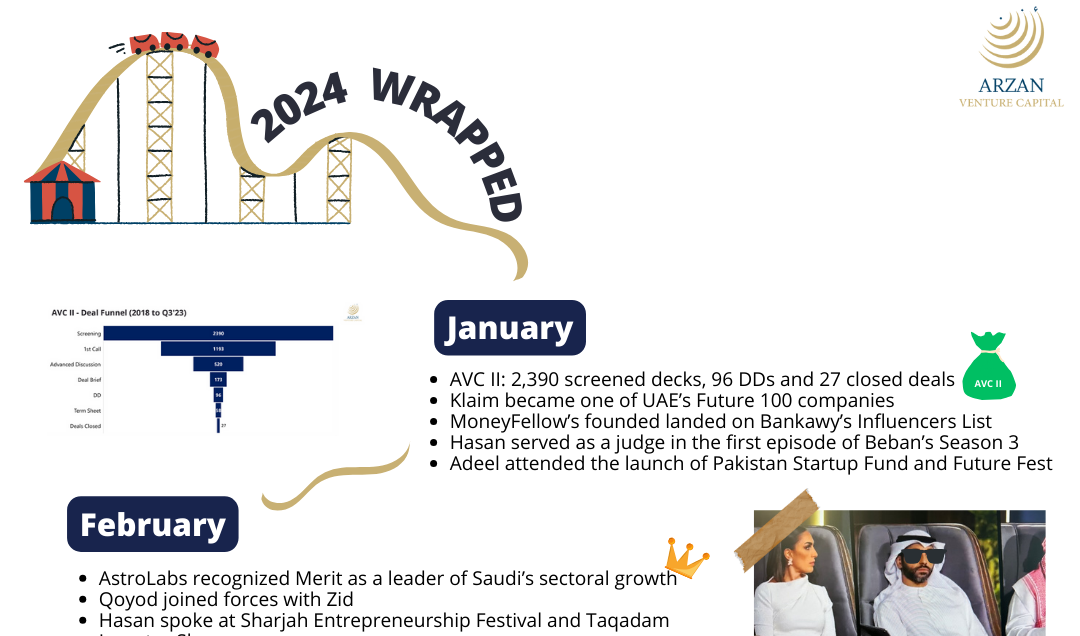

blood, sweat and ramen

From Uber to CloudKitchens, via The formula of iteration

Before Uber, the largest company that Travis Kalanick had run had 12 employees… Red Swoosh was a peer-to-peer content delivery network. He admits he was too early in the game. He didn’t pay himself a salary for the first 4 years. “At some point I had socks that said blood, sweat and ramen,” he recalls. He sold Red Swoosh to Akamai Technologies in 2007 for $19 million.

Uber had at least 15,000 employees when Kalanick left in 2017.

During his 7-year tenure, the startup went from 0 to 70 countries, 5 billion rider trips and $70 billion valuation.

Uber has completed 16 acquisitions to-date, among them Careem in 2019 (2 years after Kalanick’s departure).

It all began in Paris (a ride-home romance)

The myth of the founding “aha moment” gets glamorized a lot. Kalanick didn’t have it. Unless a tiring, 3-mile walk back to the hotel in late-night Paris counts as one.

“Man, I wish we could just push a button and get a ride.”

— Garrett Camp, co-founder of Uber

It was a prophetic wish indeed. Camp wanted to buy 20 S-Classes and get 40 drivers in a parking garage. Kalanick told him they didn’t need any of that.

Camp: class.

Kalanick: efficiency.

Moving atoms

You’ve got to find your sport. The sport you’re built to play. Mine is squash, running high-performing funds and revamping old family businesses in between.

Kalanick’s sport is digitizing the physical world — treating atoms like bits. A social media app wins if it gets your attention and takes your time. Kalanick wants to do the opposite: give you your time back.

He views the world through the lens of computing — but physical:

– CPU = manufacturing (manipulates atoms)

– Storage = real estate (stores atoms)

– Network = logistics/transport (moves atoms)

“I didn’t think of it like this at the time, but Uber was digitizing network for the physical world.”

Kalanick’s recent company, CloudKitchens, tackles manufacturing and real estate. Cooking-as-a-service. The idea behind is that the user gets something so high quality, so cost efficient and so convenient that it’s approaching the cost of the user going to the grocery store. Almost like what Uber did to your car.

“What you get in return… you get your time back to do all the other things in life you love.”

Now ask yourself – is your product or service based on stealing time from the user or giving it back? How can you make it only about giving back?

Do PMD (or don’t)

Uber expanded to new countries quickly, but its copycats and clones would already be present in some of those new markets. That’s why Kalanick came up with PMD – Parallel Multicontinental Deployment. (No, it’s not any scary Cold war stuff.)

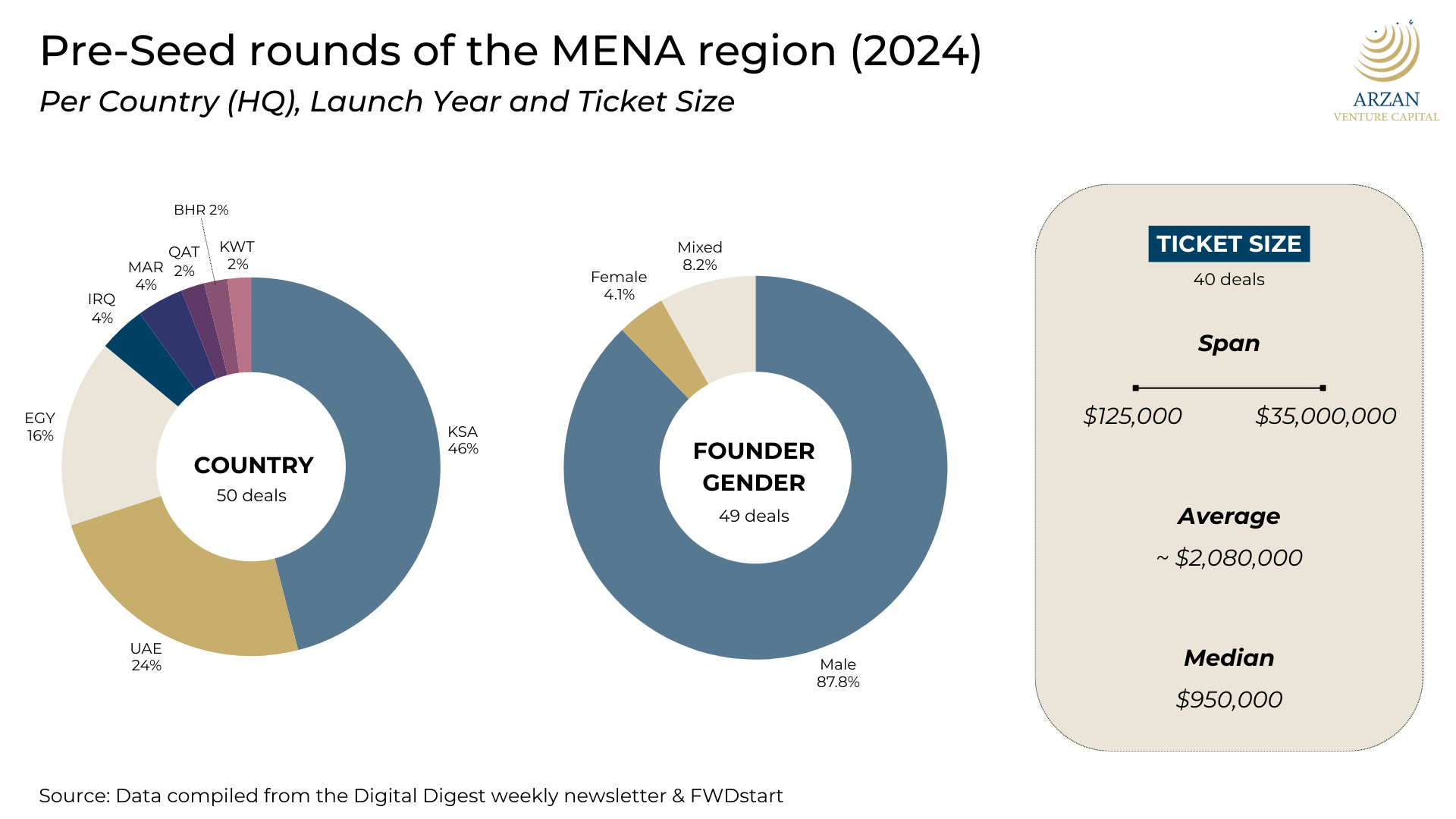

He deployed PMD at CloudKitchens. Turns out it was a great strategy for Kuwait and KSA. Not-so-great for India, Indonesia and Colombia. (Their strategy in the Middle East was so effective, in fact, that CloudKitchens may IPO their Middle East unit in either the UAE, KSA or both.)

I’d say PMD is not applicable to all regions (CloudKitchens came to the same conclusion) and what matters is where your home base is. Obviously, it also matters how early in the game you are. Remember Swvl in the pre-Nasdaq days? When they decided to expand, they couldn’t have employed PMD anymore, so they went on a shopping spree instead, in selected markets – very diverse markets (Argentina, Chile, Mexico, Kenya…) – turns out it wasn’t the right formula either. So they retreated and focused on Egypt and KSA. Rumor has it that they will be making a comeback to the non-MENA world very soon. The second time is the charm?

The formula of iteration

Innovation = Big P (progress) ÷ little r (risk)

Iterating is a systematic way to de-risk progress. Risk can come in the form of time, money, reputation… your health, too. If risk gets to zero, innovation can go on till infinity. “How important iteration is… I guess that’s like how important breathing is,” said Kalanick.

Well, risk will never get to zero and we’re not in a business of zero risk.

When is the right moment to give up and move on?

A mental checklist before quitting a project:

Step 1 – Do you still believe? This one is obvious. Please move on if you don’t believe.

Step 2 – Are you the right person to do it? This is tied to self-awareness and knowing what sport you’re playing. Maybe you used to be great at tennis but it doesn’t excite you anymore. Time to find a new sport… Squash?

Step 3 – Are you about to do significant mental or physical damage to yourself by continuing? Are you having apocalyptic dreams or nightmares? Well, “money will not buy you happiness, but it will pay for therapy,” argues Kalanick.

Here’s when I found out it’s the right moment to shift gears with my startup Pentugram:

Although I believed in Pentugram’s potential, I recognized that I wasn’t the right person to lead it. That’s why I brought in the right co-founder, which enabled us to build value and ultimately achieve an exit. (And avoid the apocalyptic nightmares in Step 3.)

|

TL;DR (too long; didn’t read)

Travis Kalanick popped up at the 2025 Abundance Summit to drop wisdom on startups, scaling and digitizing the real world. From ramen-fueled Red Swoosh days to Uber’s global takeover and now CloudKitchens, he's all about giving people their time back. His mantra? Innovate by iterating (a lot), know your “sport,” avoid scaling failure, and if you’re having apocalyptic nightmares—maybe it’s time to walk away.

|

We welcome the fintech Connect Money to our family (a spin-off from Lucky)

Serving140,000 SMEs in Saudi (Hala^^)

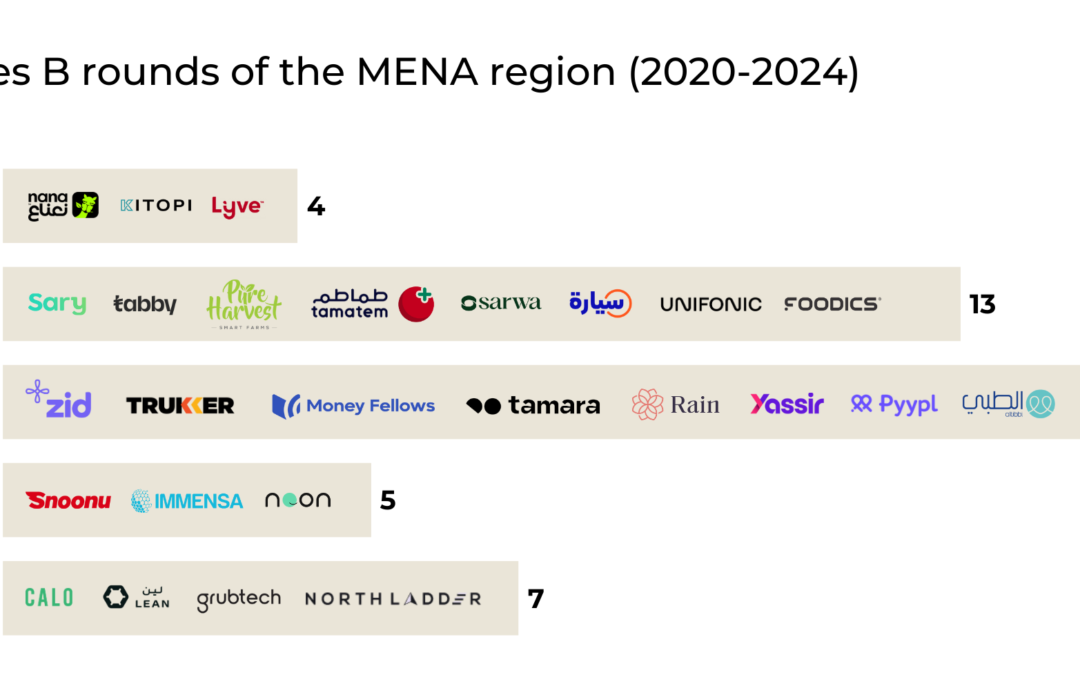

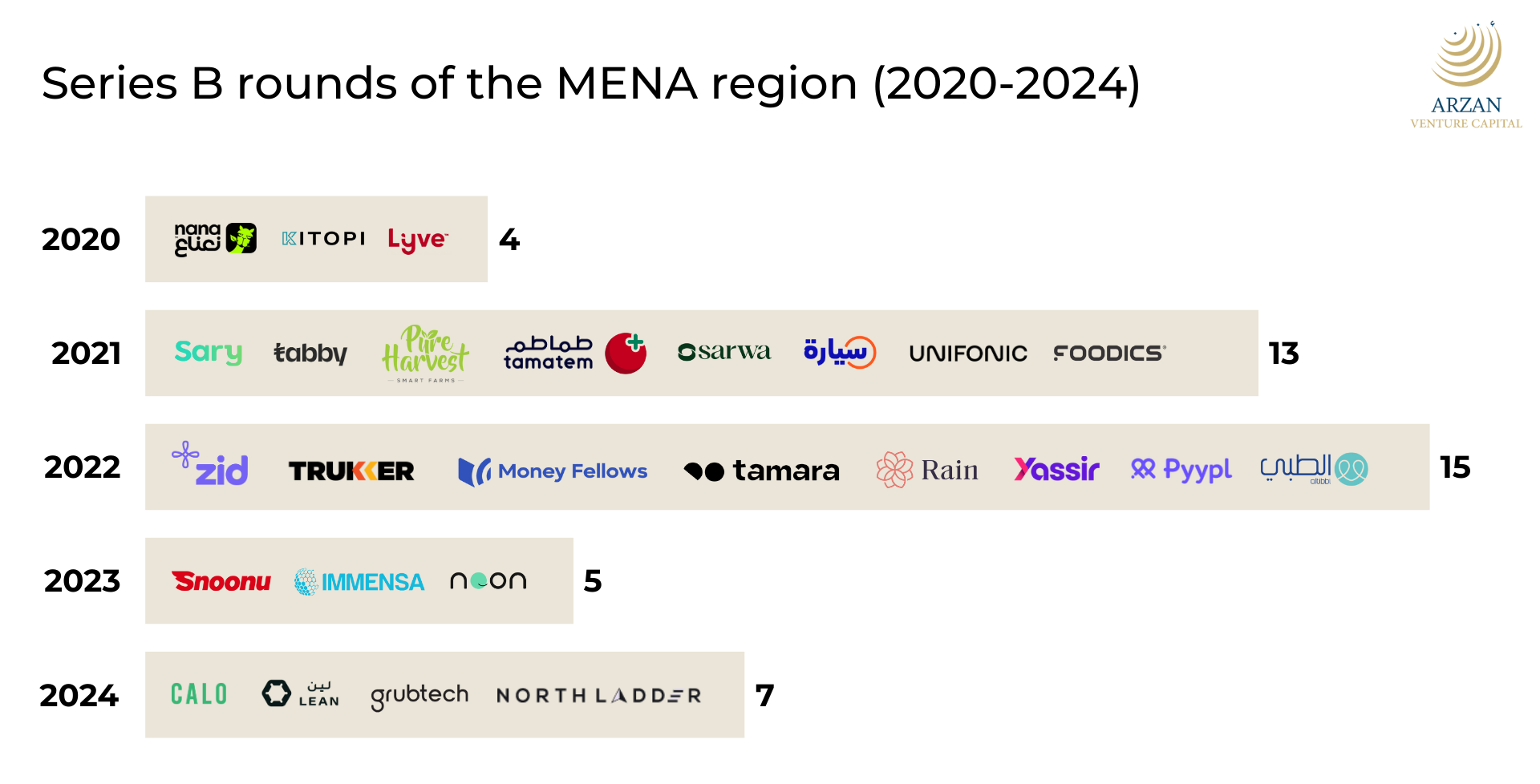

TruKKer Turkey among Best Workplaces in Turkey

From a local farm to Louis Vuitton stores (spotlight: dates)

Taker’s tips for dealing with cancelled reservations in restaurants

- Head of Strategy at Hala (Riyadh)

- Finance Operations Manager at Hala (Riyadh)

- Scrum Master at Hala (Riyadh)

- Business Development Specialist (Logistics) at TruKKer (Riyadh)

- Executive Support Partner at Money Fellows (Cairo)

- HR Operations Specialists at Khazenly (Cairo)

Come what May, we’re busy iterating 😉

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2025 Arzan VC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list