these 18 startups could go public in the next few years

What’s next? If you’re a fund manager, your What’s next? sounds like “How can I complete the fund cycle?”. If you’re a startup founder who has taken his/her startup through a good amount of funding rounds, it sounds more like “If I want my company to go...

this award-winning ERP is our 47th investment

We’ve just made our 47th investment which is also the 4th investment of our AVC Fund III. It only makes sense that this issue will be all about HulexoA, the award-winning ERP solution based in Abu Dhabi, currently eyeing Kuwait and Saudi. Welcome to the...

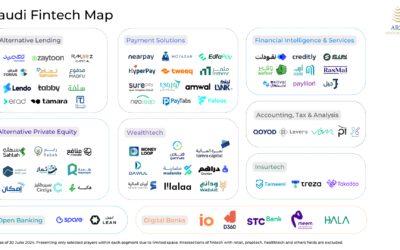

+360% for Saudi fintech (+ the latest fintech map)

Is it a surprise that, for the third half-year in a row, Saudi attracted the most of the capital deployed in the MENA region? Nope. The big surprise though? Funding for Saudi fintechs grew by 360% (vs. H1’23) and it remains the most transacted sector. ...

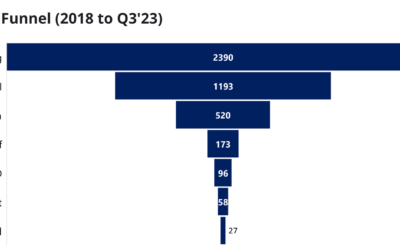

from 2,390 screened decks to 27 deals

I can hardly believe that our AVC II is done investing. Its investment period was over in Q3 of last year. AVC II is a body of over 2,300 screened decks, almost 1,200 first calls and over 170 deal briefs. All spread across 5 years. Considering that our focus...

our immortal algorithms

Turns out my last month’s newsletter was a good prelude to Swvl's news of their $3.1m net profit in 2023 from few days ago. Today I want to talk about the future, why the future is a verb and why Japanese have a word for companies older than 100 years. I'll...

1,420.18% growth over the past 6 months

Are you following up on the latest tech stock resurrection on the block? It’s been exactly 7 years since the company was established and 2 years since its debut on Nasdaq, which was followed by a valuation drop from the initial $1.5 billion to $16 million in...

SUBSCRIBE