I can hardly believe that our AVC II is done investing. Its investment period was over in Q3 of last year.

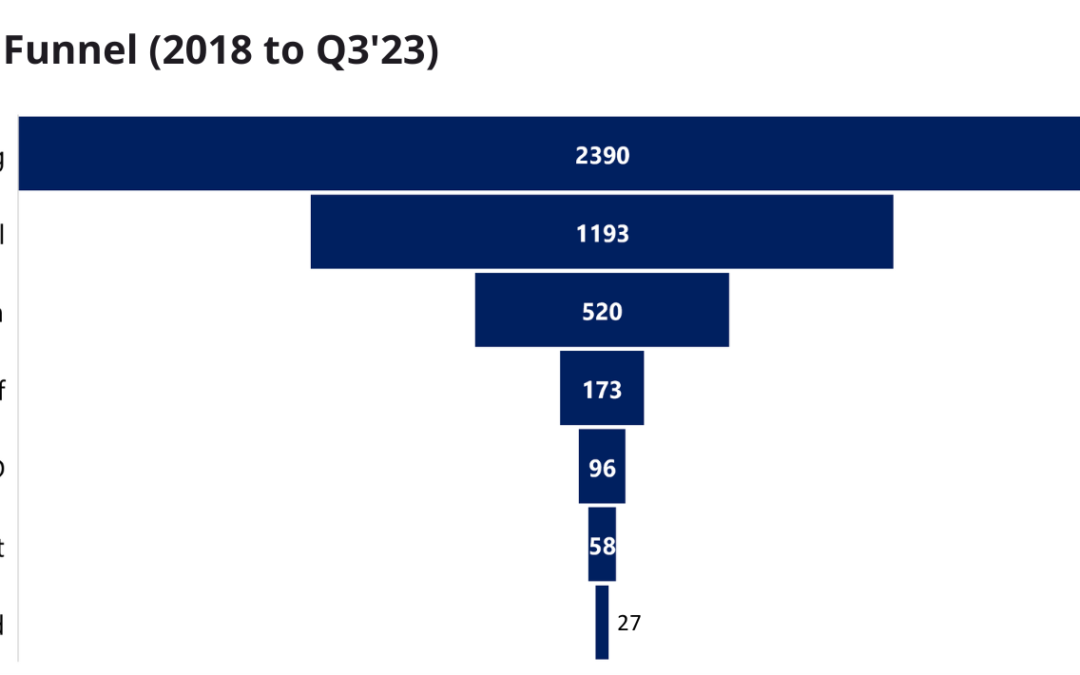

AVC II is a body of over 2,300 screened decks, almost 1,200 first calls and over 170 deal briefs. All spread across 5 years. Considering that our focus was on startups in the MENA region only, I don’t think those numbers are little, but I’d like to hear your thoughts on that 😉

From 2,390 screened decks to 27 deals

Our Fund II strategy was clear from the start: target Pre-Seed to Series A opportunities that are either MENA-based or have MENA founders or are selling in MENA. We were generally industry-agnostic. We also cared about MVPs, measurable traction and having technical co-founders. Looking back, we did end up investing in a few startups with a sole founder and, in all those cases, we kept encouraging and assisting the existing founder with finding a suitable partner. We don’t recommend founders to remain solo.

The team reviewed deals very religiously. Like I said above, AVC II is a body of 2,390 screened decks that transformed into 96 DDs. The team sent 58 term sheets which resulted in 27 closed deals. All of that happened between 2018 and Q3 2023.

Out of the total opportunities screened by AVC II since 2020, 25% were Egypt-based, 24% were from UAE and 17% from KSA. We also reviewed deals from Kuwait, Jordan, US, Bahrain, UK and others.

In terms of industry segmentation, fintech was the most common sector (20%), followed by e-commerce (9%) and SaaS (8%). Plenty of marketplaces, healthtech, F&B, edtech, logistics and AI.

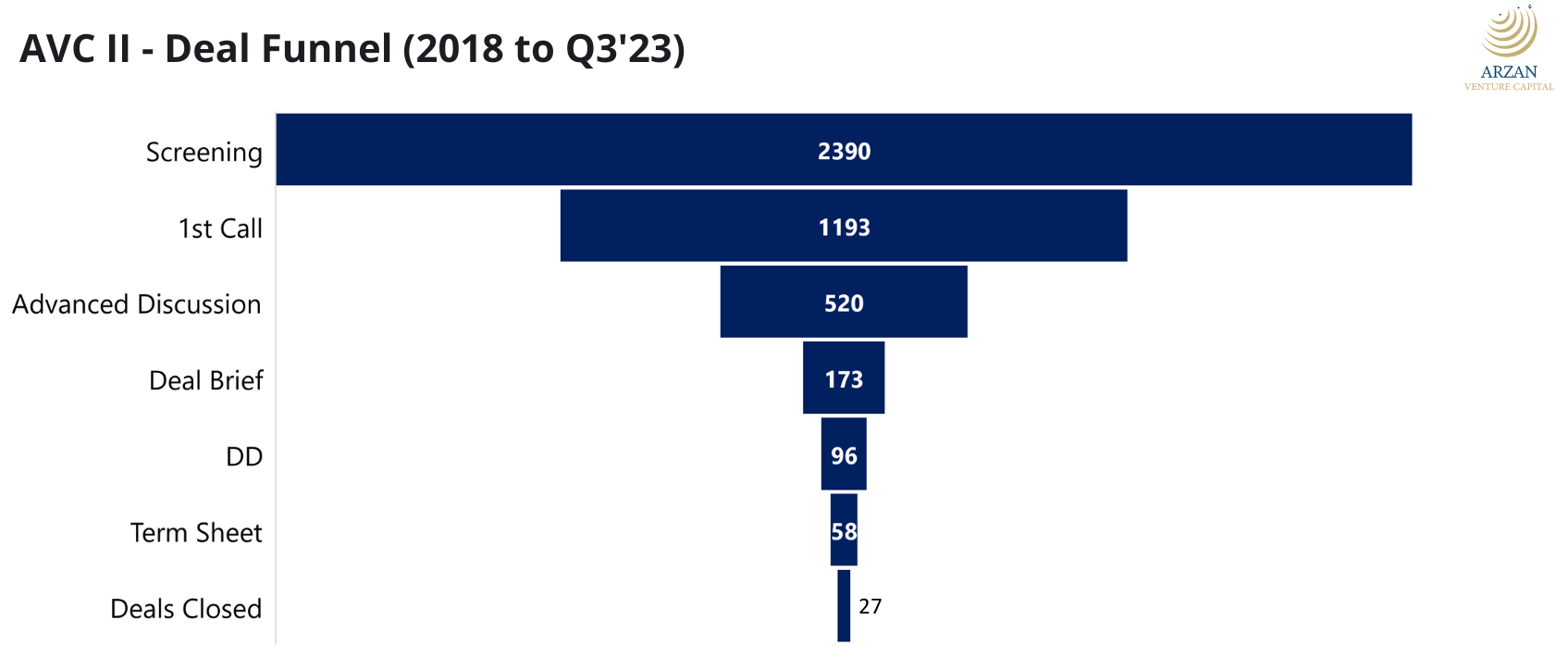

Our deal screening peaked in 2020 & 2021 – the Covid era – when we reviewed 729 and 629 deals, respectively. It seems WFH was more intense than pre-Covid office and our deal briefs were on fire!

Note the higher proportion of deals closed in the first 2 years of the fund (2018 & 2019) vs. the total deals screened during the same period. Although we screened many more deals in 2020 & 2021, those decks didn’t materialize as they would have if we used the conversion ratio of the first 2 years. 2020 & 2021 were certainly hype years and I’m glad we didn’t jump on just any deal for the sake of it.

You can see we kept screening till the very end (Q3 2023) however we ended up using our remaining dry powder in a few follow-ons. And in parallel, our AVC III began investing.

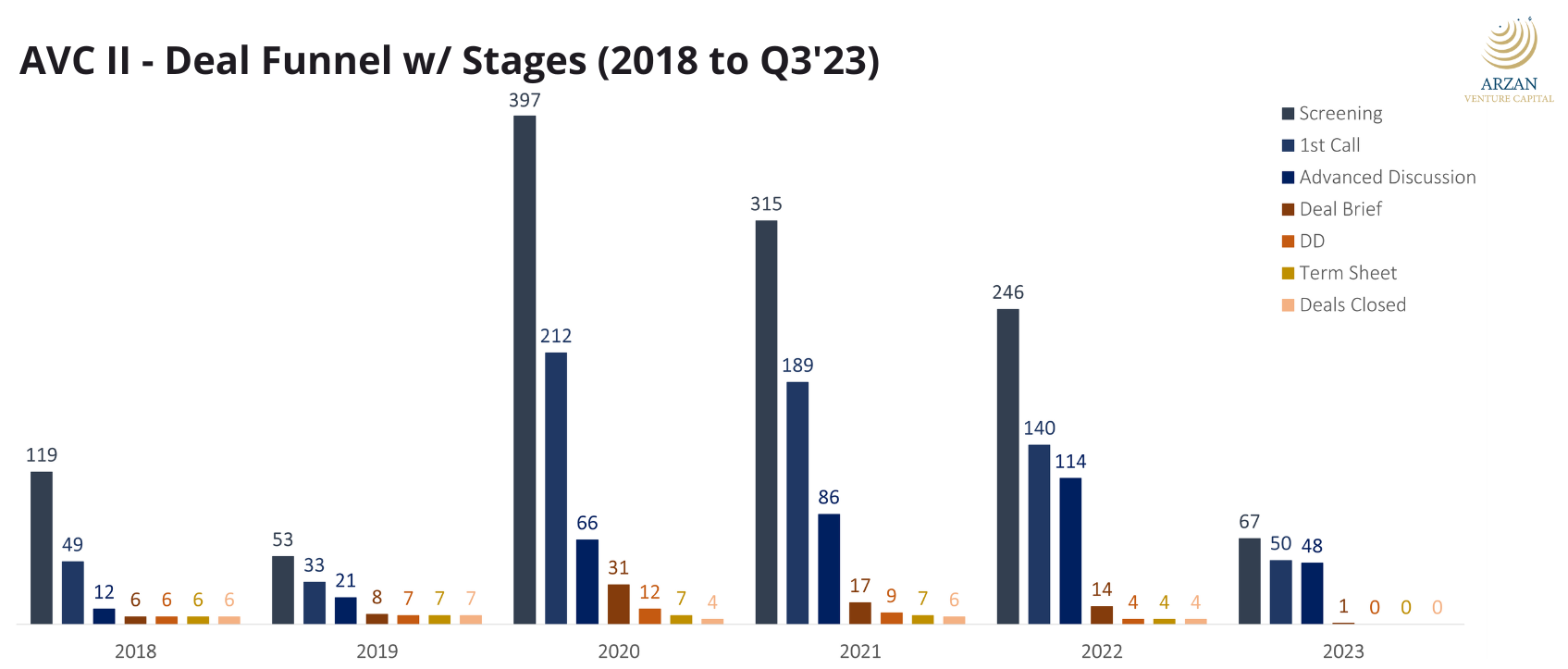

So… 27 closed deals.

What were their stages when we got in?

Out of the 27, we made follow-ons in 11 (until our dry powder went dry). 3 companies received our follow-on more than once.

The most active grasshoppers in our portfolio have been the Seed deals. Out of the 12 Seed investments we made, 2 got acquired, 2 remain at Seed, 4 progressed to Pre-A, 2 to Series A, 1 to Pre-B and 1 reached as far as Series B. For the sake of comparison, Philip Bahoshy (MAGNiTT) recently published data on 813 MENA seed-funded startups (2015-2020). We beat those statistics. 33% of our seed investments made it to Series A (vs. 15% acc. to MAGNiTT). 8% made it to Series B (vs. 4% acc. to MAGNiTT).

21 companies of our AVC II companies remain active. The fund is a vivid mosaic and the next 2-3 years will tell its final story. Our philosophy goes against Peter Thiel’s opinion on winners and losers; we try to spend time with everyone, including non-grasshoppers = those that are not moving the needle for us.

Right now we’re planning to invest in 4 early-stage startups before the year ends – through our Fund III. The team is currently exploring verticals like Loyalty & discounts, BI SaaS, DaaS (D = Device), AI/Data, F&B Data and HR tech.

…awaiting your decks.

|

TL;DR (too long; didn’t read)

Our AVC II is a body of 2,390 screened decks that transformed into 96 DDs. The team sent 58 term sheets which resulted in 27 closed deals. All of that happened between Q4 2018 and Q3 2023. I dissect through the years and stages and look for grasshoppers. ALSO! We’ll be investing in 4 new companies this year via AVC III – maybe also yours? 😉

|

Merit raised $12 million and partnered with SAIB

645,000+ accelerated claims

NEV program by TruKKer

Hala gets a debt-based crowdfunding license

The future of finance is customer obsession

and… Gameball has a new look and offers Summer Internships

- Regional Accounting Manager at Cartlow (Cairo)

- Fraud & Operational Risk Manager at Hala (Riyadh)

- Partnerships Manager at Armada (Kuwait)

- Senior BI Engineer at Money Fellows (Cairo)

- Senior Developer at Carseer (Amman)

- Backend Tech Lead at Qoyod (Cairo, hybrid)

- Financial Analyst at Khazenly (Zamalek)

Till next one,

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2024 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list