Is it a surprise that, for the third half-year in a row, Saudi attracted the most of the capital deployed in the MENA region? Nope.

The big surprise though? Funding for Saudi fintechs grew by 360% (vs. H1’23) and it remains the most transacted sector.

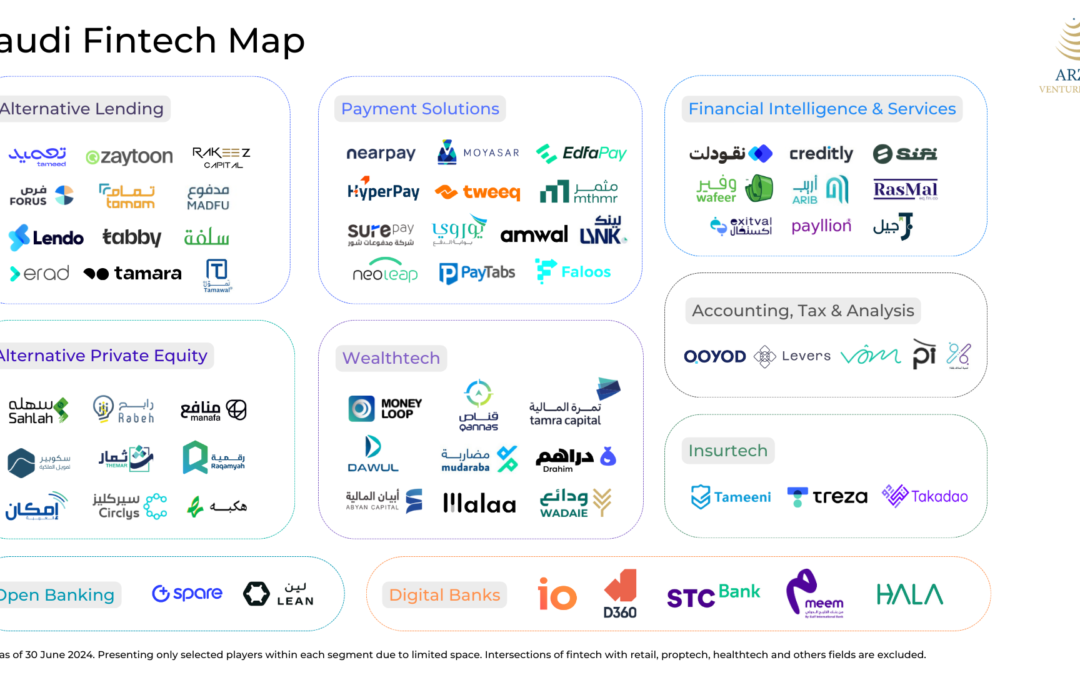

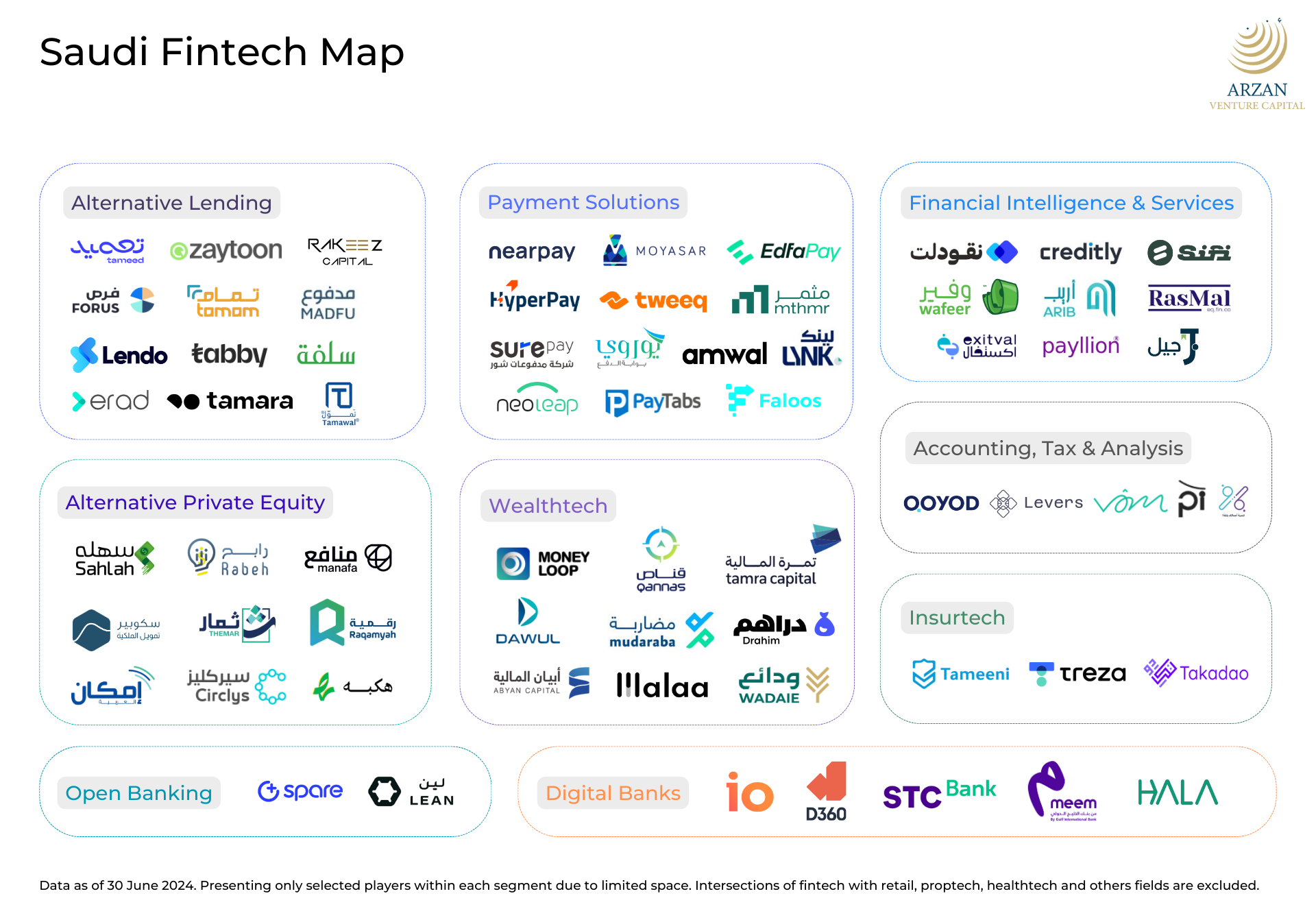

Let’s map its players across 9 verticals.

+360% for Saudi fintech (+ the latest fintech map)

MAGNiTT & SVC dropped their H1 2024 Saudi VC report just days ago and it surely comes in handy. I was planning to write about Saudi fintech anyway 😉

In the first 6 months of this year, KSA attracted $412m worth of VC funding compared to UAE’s $225m. The $412m represents less than a half of what Saudi got in H2 2023.

In terms of the number of deals, UAE retains a strong grip on its #1 spot with 83 deals vs. 63 for KSA. And, for the first time since 2020, Saudi hasn’t recorded any late-stage deals in 2024 so far… but look at the total growth of fintech funding: +360% vs. H1 2023. The number of fintech deals has sunk though; -40% compared to H1 2023.

There was an annotated map of UAE fintechs circulating on X recently and it made me realize that I hadn’t properly dived into fintech since we released our general, MENA fintech report… well, fintech is making headlines around the region on an almost daily basis, so it’s becoming kinda dull to talk about it? Nevertheless, drafting a fintech map and sharing it with you guys certainly never hurts.

So, let’s map.

I analyzed around 100 Saudi fintech startups across 9 verticals.

Looking at the growth of Saudi fintech, we should soon opt for compiling reports of the size of Oxford Business Group country reports in order to map the progress I’m presenting only selected players within each vertical due to limited space. Intersections of fintech with retail, proptech, healthtech and other fields were excluded… they require a map of their own 😉

Payment Solutions dominate the market in terms of the number of players, tightly followed by Alt Lending, Alt PE, Wealthtech and Financial Intelligence & Services platforms.

Notes on Digital Banks:

— STC Bank was formerly known as STC Pay, which started off as a mobile wallet in 2018.

— I included Hala because one doesn’t need a crystal ball to see them there in the imminent future. They’re on the right path.

Anyone I left out? Send me your tips & comments.

Reminder: We’re screening early-stage startups at the moment. And we will invest in 4 before the end of this year… awaiting your decks.

|

TL;DR (too long; didn’t read)

In the first 6 months of 2024, Saudi fintech attracted +360% funding compared to H1 2023. I analyzed around 100 Saudi fintechs and mapped them across 9 verticals. Payment Solutions dominate the market in terms of the number of players, tightly followed by Alt Lending, Alt PE, Wealthtech and Financial Intelligence & Services platforms.

|

Swvl secured a 5-year contract with e& ($6.3m)

TruKKer’s PPP with Dubai’s RTA

Certified Loyalty Marketing Professional Workshop in Riyadh

The Loyalty Circle Meetup (Riyadh edition)

Citron’s 2024 Collection

Summer internships at Money Fellows and Lucky

A massage chair with a POS

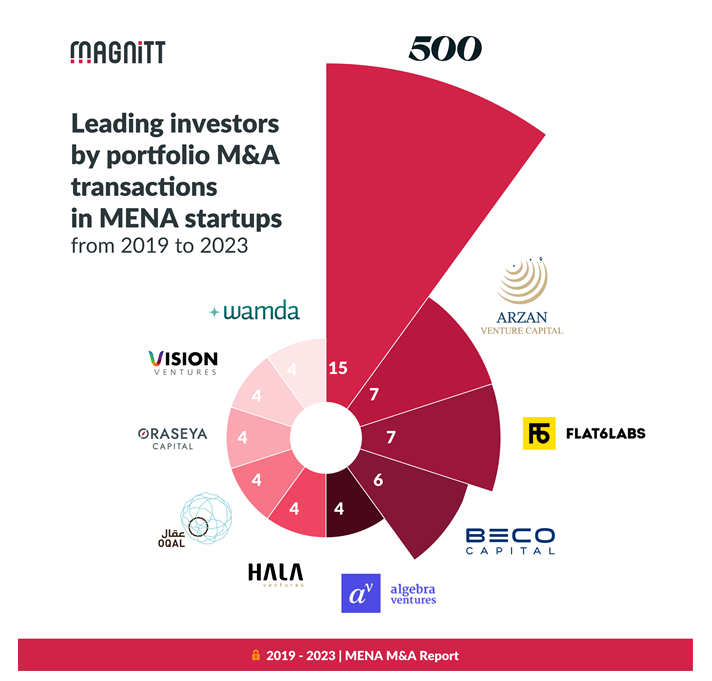

And… We are no. 2 investor by portfolio M&A transactions (thx, Philip / MAGNiTT!)

- Senior Key Account Manager at Hala (Riyadh)

- Project Manager at TruKKer (Dubai)

- Collection Manager at Money Fellows (Cairo)

- Backend Developer at Hala (Abu Dhabi)

- Senior Designer at Cartlow (Cairo)

- Senior Specialist, Sales at Zid (Riyadh)

- Sales Executive at Khazenly (Cairo)

- Sales Executive (B2B) at Cartlow (Dubai)

I’m in Cairo until August 5th, see you?

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2024 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list