How are you coping?

In a parallel world, I’d like to take a more holistic look at cap tables – their shape and health, because some cap tables out there could benefit from some tidying up

Fixing (un)investable cap tables

Your cap table (CT) may not always look like your dream team, but a messy CT structure is sometimes the sole reason why an investor decides to pass on an investment.

Before I get to the types of messy tables, recall my recent address to founders: You should treat your equity like gold (or diamonds?). It’s about finding a balance between how much you want to own and how much faster you want the business to grow. Not striking that balance can often turn into an obstacle and render your startup uninvestable. Have no fear though; most messy structures can be tidied up over time. I think it should always be a joint effort of all shareholders – founders & existing owners/investors alike – to work together to avoid a state/situation when the startup becomes uninvestable due to an unhealthy ownership structure and cannot raise – which will negatively impact ALL existing shareholders.

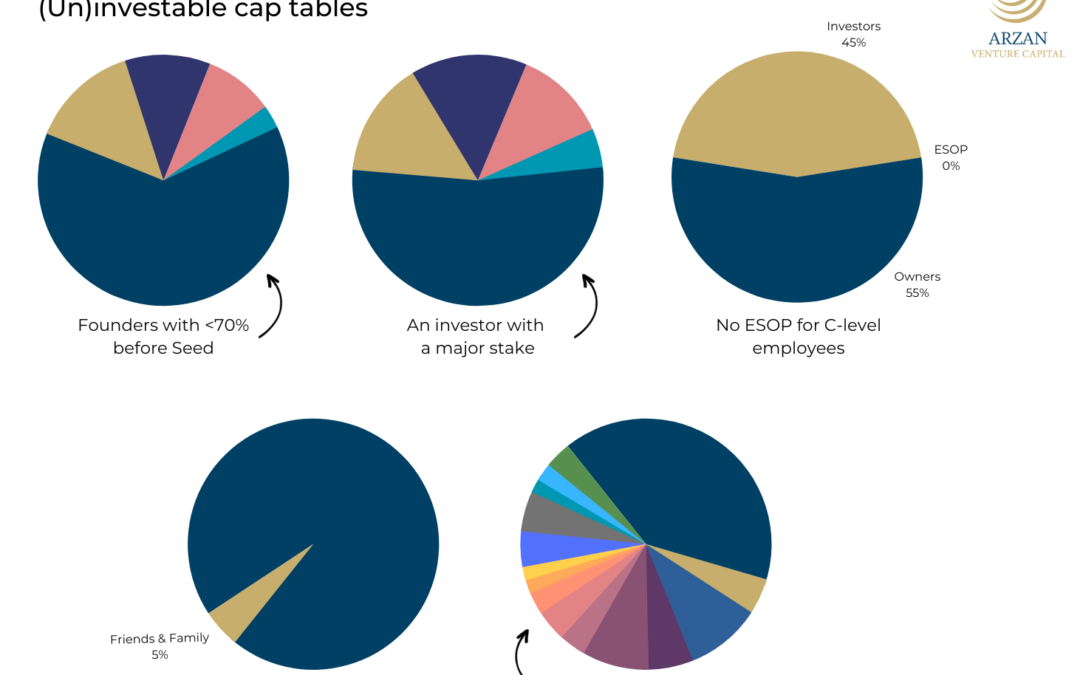

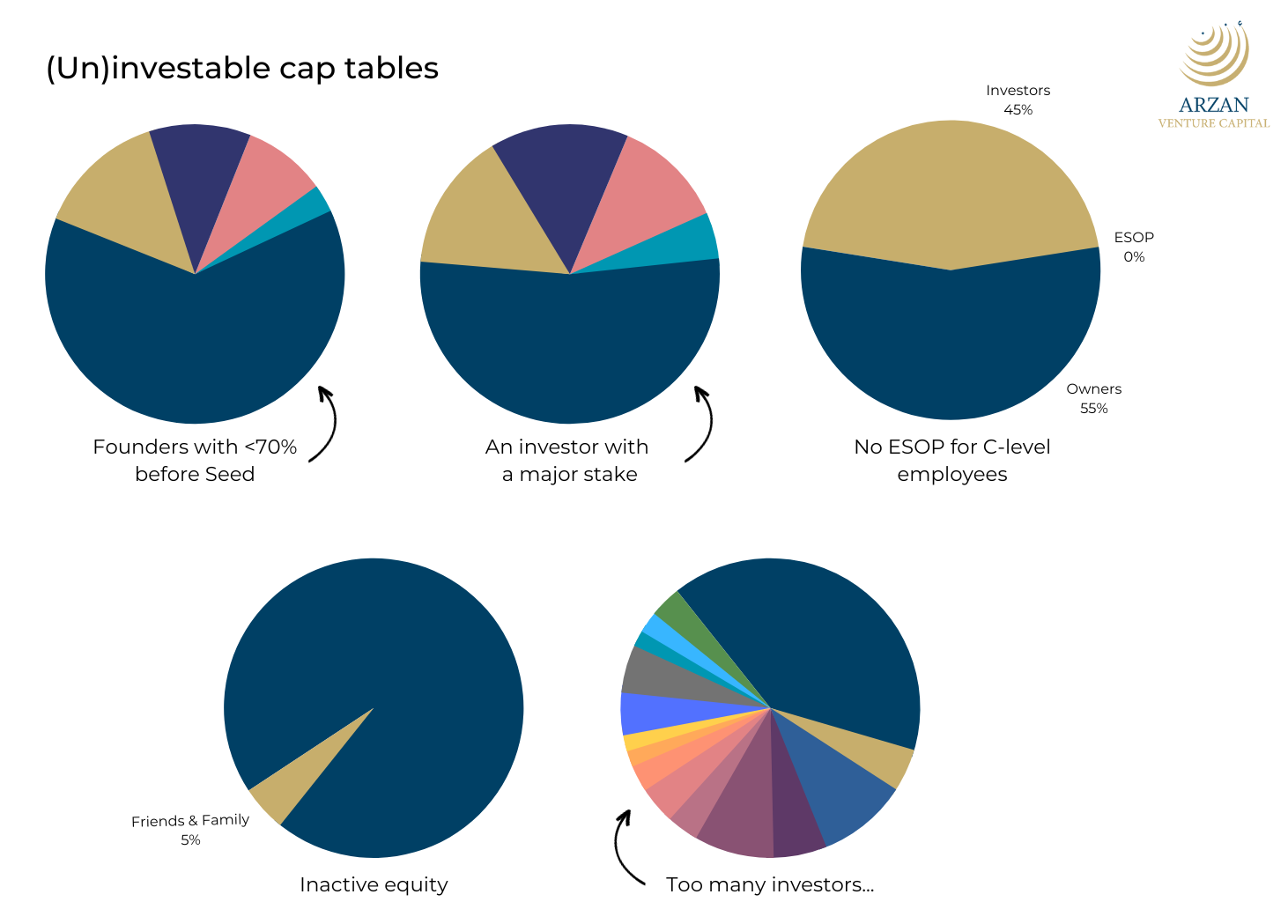

Types of messy cap tables & how to fix them:

– Founders with <70% before Seed. Imagine a startup with 3 co-founders holding collectively 75% of shares before Seed, while no investor on the CT has more than either of the 3 co-founders… – this is quite a common scenario. What could raise an alarm are founders with <70% before Seed and an investor with a relatively high share standing out from the rest of investors. Founders that find themselves over-diluted before Seed may not feel as motivated and incentivized as founders with healthy ownership. That’s why it’s important to achieve the MVP phase without giving up too much equity for a relatively small amount of funding (usually hundreds of thousands of dollars). If you need to raise that initial round, use SAFE notes or vesting schedules. Also, be careful about the initial valuation and ensure it reflects your peers and the prevailing market conditions.

– An investor with a major stake. An investor with a stake of >50% can pose a clear threat to the health of the startup’s overall ownership structure and its investability in the future. Examples include startups that are products of spin-offs. Or startups that relied heavily and/or repeatedly on one investor. Example: a post-B startup with founders owning collectively 5% (over-diluted!), a major investor owning >50%, two other investors collectively owning 30% each and an ESOP pool. If new investors are to come aboard, it will be imperative for them to bring that one majority owner to a healthier% – perhaps through a secondary where the already-very-small founders’ ownership won’t suffer from dilution.

– No ESOP for C-level employees. Example: a startup owned by another company (55%) and a pool of investors (45%). The startup’s CEO has no shares although, in a fair world, he would have been given the co-founder title a long time ago. Unfair practices should have no place in 2023. (Don’t pick on my use of “a fair world” – we’re all aware that the meaning of that phrase has recently become a kind of mirage.)

– Unhealthy amount of inactive equity. Inactive equity belongs to shareholders who are not actively involved in the startup. Shareholders such as Friends & Family (F&F) and/or business angels who came in at a very low valuation in the founding phase. I’d like to argue here against the proposition that ex-founders’ equity should also be also considered a kind of inactive equity, because – in case of any founder – we shouldn’t forget their long-lasting contribution in the early years of the business and, as thus, they cannot be simply put in the same basket with F&F and other actual inactive equity owners.

– Too many investors. Having a CT resembling a colorful palette is not uncommon and it doesn’t have to be a bad thing as long as all investors are aligned with the founders’ vision. And quick to sign documents.

Any other (un)investable tables that you’ve seen out there?

|

TL;DR (too long; didn’t read)

I analyze (un)investable cap tables (= messy cap tables) and come up with 5 types that are standing out: (i) Founders with <70% before Seed, (ii) An investor with a >50% stake, (iii) No ESOP for C-level employees, (iv) Inactive equity and (sometimes) (v) Too many investors. I also explain how each can be fixed because, although your cap table may not always look like your dream team, a messy ownership structure is sometimes the sole reason why an investor decides to pass on an investment… so let’s tidy it up.

|

Dtonic Corporation’s $1.5m investment in Retailo

Swvl’s FY2022 results

#PeopleOfEndeavor: Ahmed Wadi

Another proud #MadeInSaudi brand

Decoding fintech jargon

+1 photo from this week’s /MoneyTech in Kuwait:

- Treasury and ALM Manager at Money Fellows (Cairo)

- Strategy Lead at TruKKer (Dubai)

- Senior Graphic Designer at Subsbase (Cairo)

- Senior Payroll Specialist at Hala (Riyadh)

- Quality Assurance Engineer at Gameball (remote)

- Content Validation Specialist at Cartlow (Cairo)

Adeel will be leading NIC Karachi’s FI Session 13: Investor Pitch Review on November 17, where he will be mentoring startups participating in the NIC Karachi FI Summer 2023 Semester.

Take good care.

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2023 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list