M&A winter?

We’re physically heading into winter (at last!), the VC world has been in a funding winter for some time now and instead of the predicted M&A wave one could assume it’s an M&A winter. Except that… in MENA, it’s more like autumn.

Signs of life in MENA’s M&A market (Q1-Q3 2023)

If you want to see MENA’s M&A numbers right away, scroll down to the pretty info-graph. If you want some background first, continue reading.

General observations:

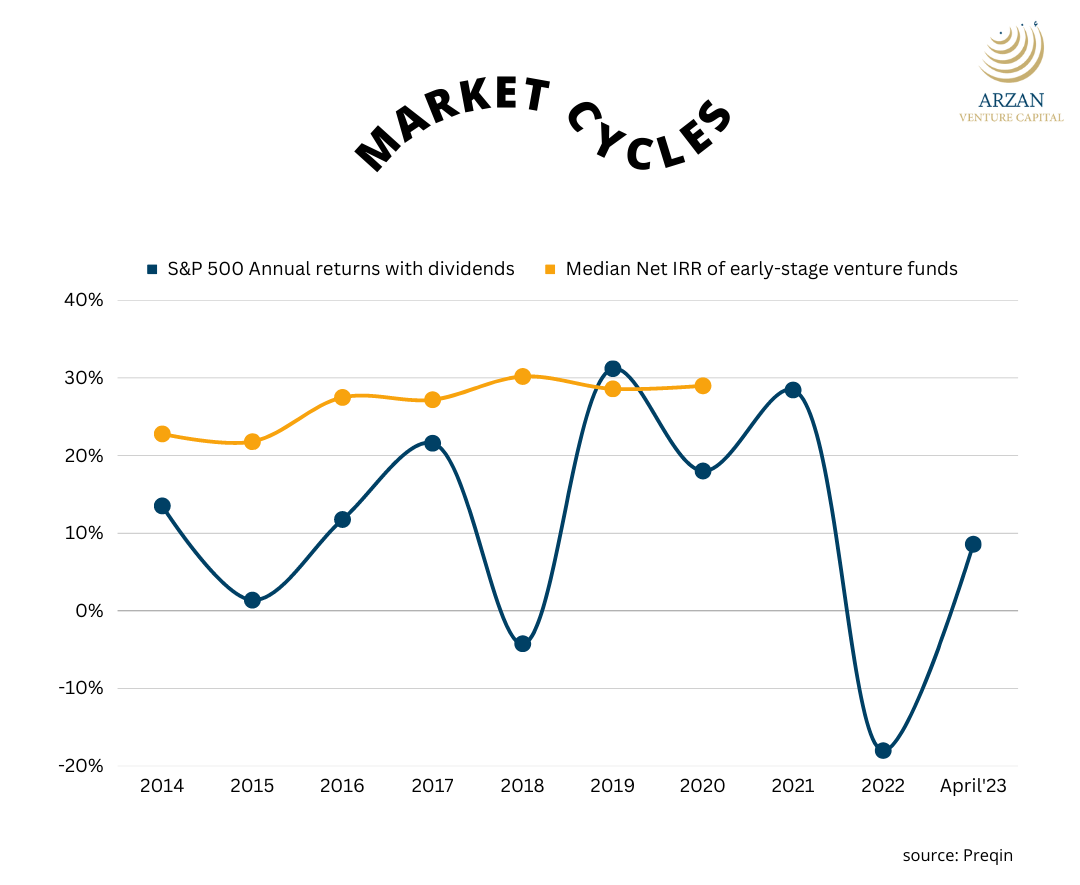

– M&As are an inevitable product of the current economic environment and the declining trends in VC funding (although October numbers are painting a better picture – at least in MENA)

– The anticipated surge in startup M&As in 2023 remains anticipated

– Carta saw 543 startups shutting down due to bankruptcy/dissolution since the beginning of 2023 (a record high compared to any previous year) – more here

– Growing regulatory pressure in US and Europe has brought big tech M&A activity to a halt

– Europe witnessed more tech acquisitions than the US in Q2’23, and that’s a continuation of a trend of the last 6 quarters

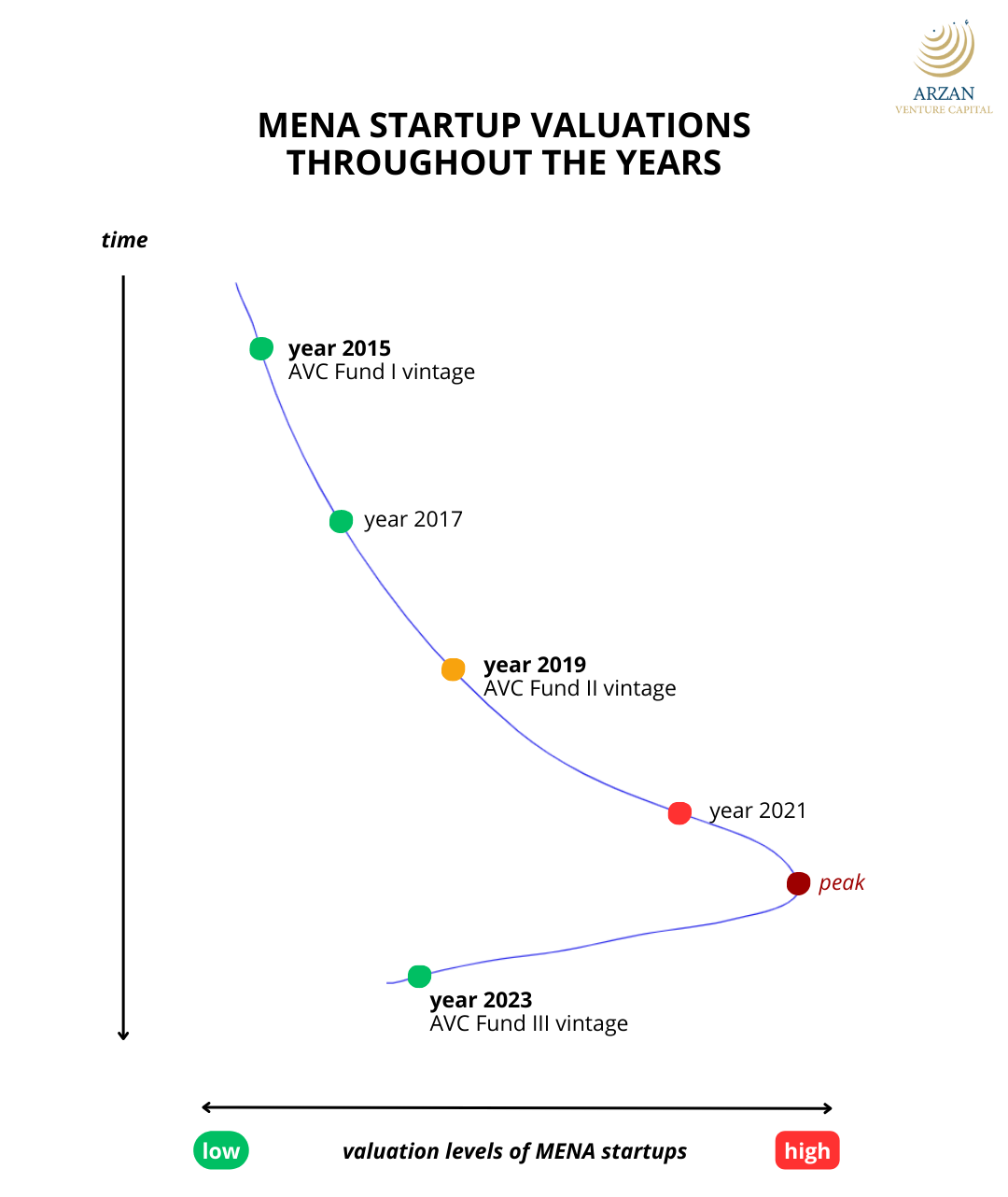

– Between Q1’22 and Q2’23, US tech M&A revenue multiples dropped from 16.3x to 7.3x

– Alternative deal terms such as earnouts and seller notes are becoming more common

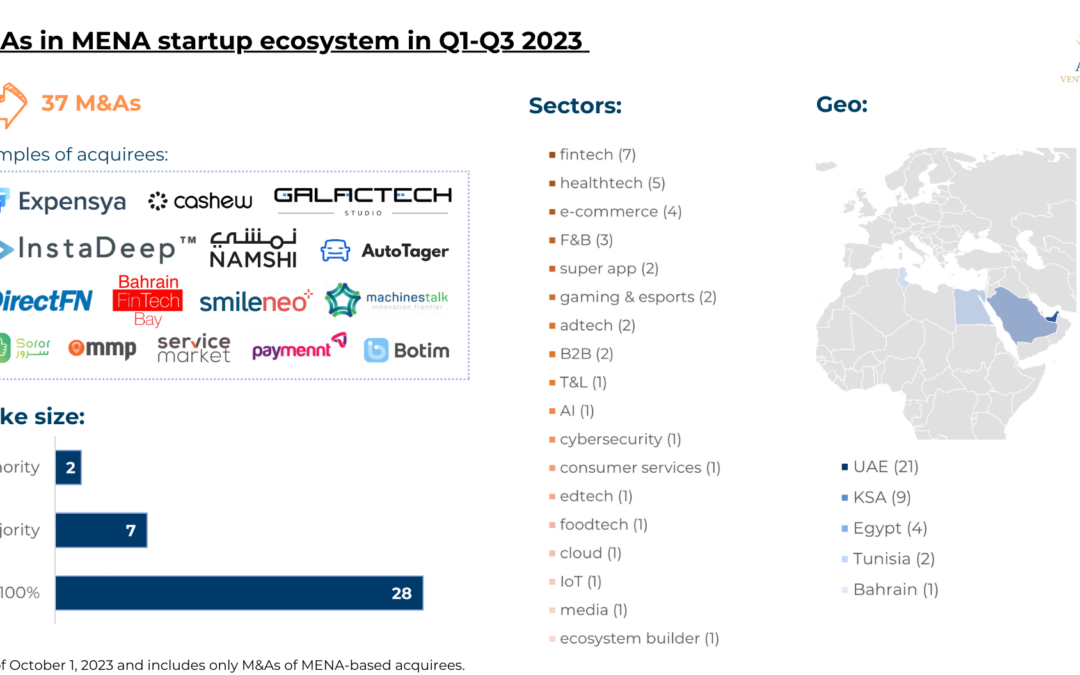

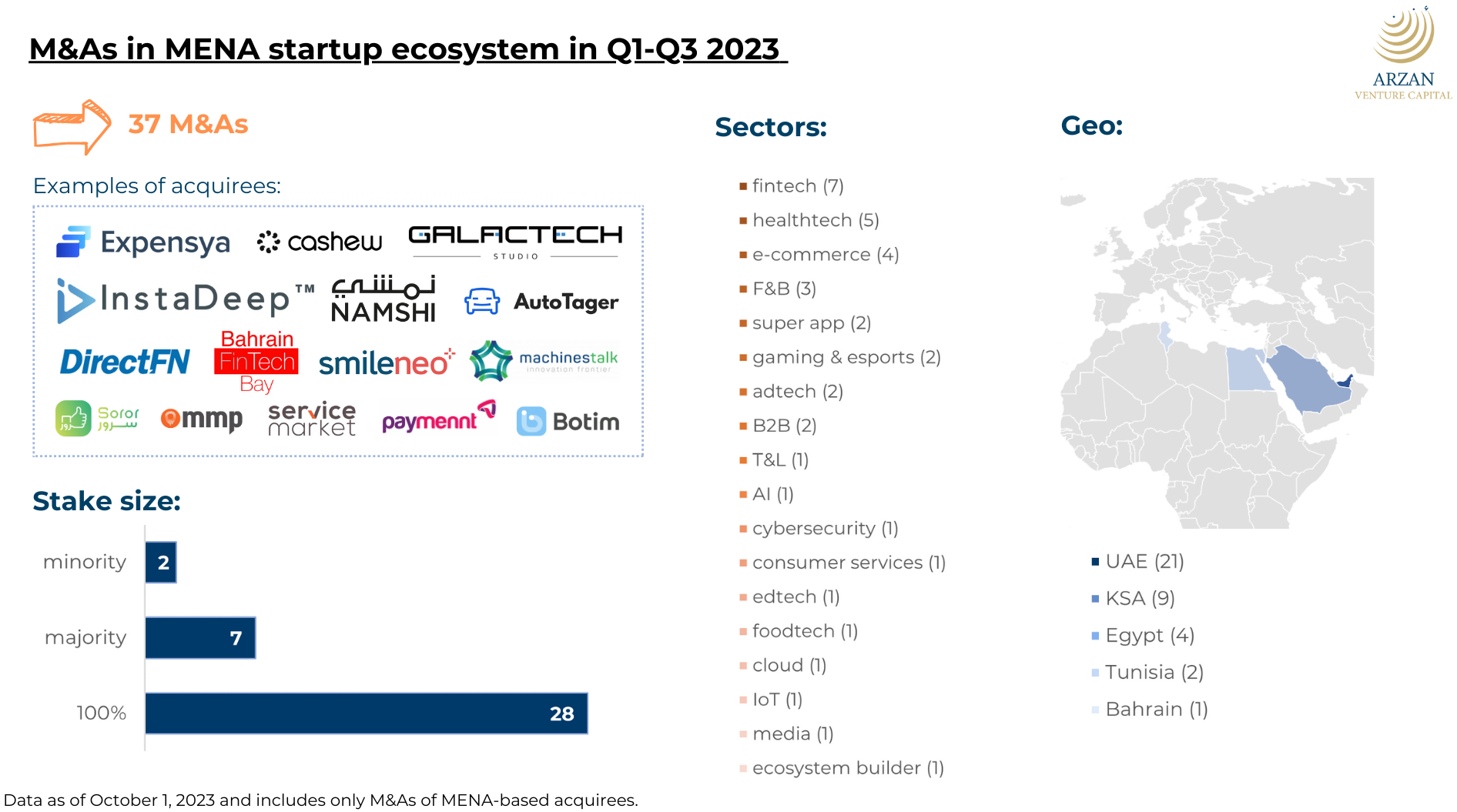

– Hot M&A areas: healthtech, cybersecurity, fintech, AI

And the region?

Our inhouse data indicates that the # of startup M&A deals in the region has been tumbling. There were 37 M&As in the ecosystem since the beginning of 2023 vs. 60 during the same period a year ago.

Even though that’s a drop, 37 is a decent number given historical stats. Only in 2022 had the same time period registered a higher figure of deals.

Where does this leave the founders?

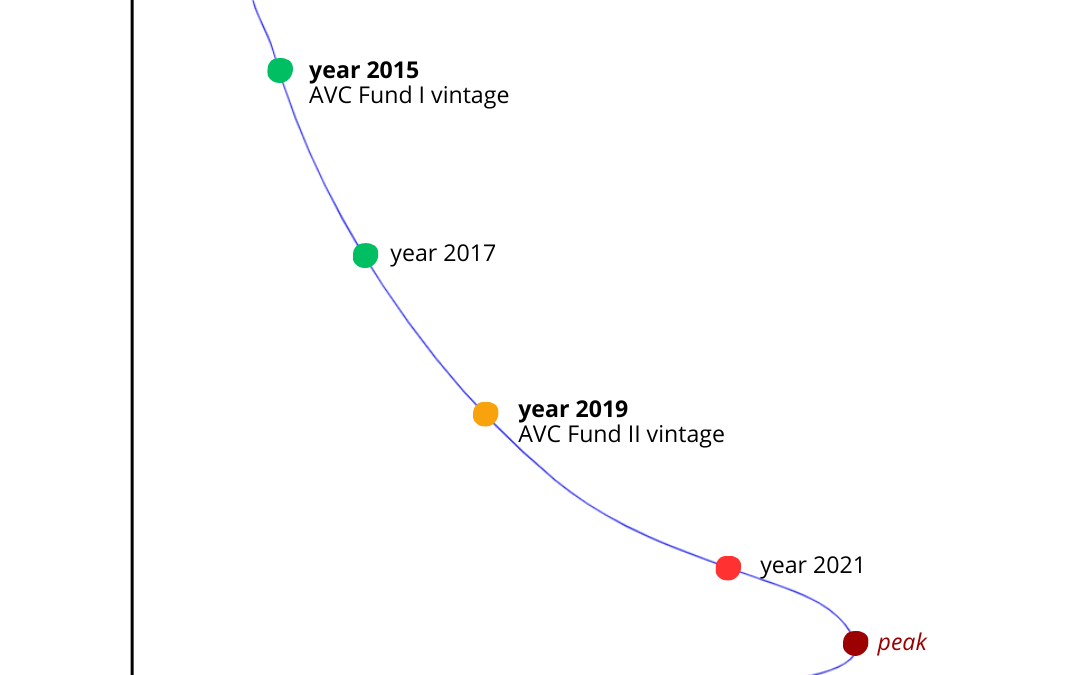

Though there have been several new-fund announcements in the past couple of weeks, these funds will take some time to deploy and overwrite the funding slowdown. Until then, startup founders will (i) keep trimming their operational costs and (ii) be more likely to opt for the next logical option (-> get acquired) to overcome their inability to raise.

If you don’t think your company is sellable (e.g., you got high burn, team deficiencies, high customer churn, etc.), explore this option: trim the product fat, focus on whatever works from the current offering and spin it off as a standalone product. And also…

What’s your runway?

Exiting early is not what most founders envision for themselves – and the scenario can be often avoided. Stay conscious of your runway and start planning for the next fundraise earlier than you initially planned to.

P.S. We got one freshly cooked exit in our Fund II. Details to be revealed soon.

|

TL;DR (too long; didn’t read)

I analyze M&As in MENA startups ecosystem since the beginning of 2023: there were 37 such deals vs. 60 during the same period in 2022. Amid the record-high number of startup shutdowns (as per Carta) and slow-down in M&As (global and regional), I discuss what options founders have going forward to avoid exiting early (or, in the worst case, shutting down).

|

Made in Egypt apps feature Money Fellows & Lucky

Khazenly in Batch 1 of 500 Global Scale-Up Program in Egypt

LinkedIn’s Top 10 Startups in Saudi Arabia

300,000 insurance claims

A newsletter for class providers

- Software Engineer (Ruby on Rails) at Qoyod (Riyadh)

- Machine Learning Engineer at Carseer (Amman)

- Head of Growth at Money Fellows (Cairo)

- Credit Collections / AR Specialist at TruKKer (Riyadh)

- Junior Accountant at Cartlow (Cairo)

- Last Mile Coordinator at Khazenly (Zamalek)

Gitex? Dealmakers (Cairo)? Ping us.

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2023 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list