EXIT🏃🏽… How can founders win exits?

Few weekends ago Laith took part in a discussion panel titled “The Endgame: Winning Exists For Startups & VCs” at RiseUp Summit in Cairo, and he’d like to share his views with those who weren’t there. Take notes.

How can founders win exits?

1) How do you as a founder decide whether to exit or not, and how do you seek advice/guidance from your investors?

I was on the panel as an investor, however this question brought back memories from when I was a founder of a fledgling startup called Jeeran – you’d know it if you have grey hair. At the time we had grown to over 7M users and we were at the leading edge of the internet in MENA. We had exit discussions with different parties ranging from full acquisition and takeover to majority stake acquisitions with a partial exit for founders. These discussions never materialized because we didn’t really know how to think about them. I can say, however, that we approached all of them with a defensive mindset. Our answer was always “Never! But let’s talk”. I have also witnessed this attitude from other founders during my work as a VC and have seen them pass on great offers only to crash and burn later. Always approach these discussions with a “Yes, let’s talk” attitude and the knowledge that these opportunities may not come around again, especially in MENA.

The second mistake we made was involving investors too early in the thought process. In fact, our investors were in some of those initial meetings, which centered the discussion around cheque sizes and valuations. We had more discussions about what we wanted to do with the company with our VCs than among each other as founders. We pretty much did not think of any other stakeholder when in fact there were many at the time: our team, families, customers, and the broader ecosystem.

Founders can feel burnt out, unable to scale or under immense pressure, resulting in a desire to exit. You will know when that feeling comes. And when it does, don’t ignore it. One of my mentors once told me: “You want to be the guy who sold it to the other guy. You don’t want to be the guy who held onto it for too long.”

Deciding to pass and continue building the business is a very exciting option. It’s also a significant undertaking that requires careful consideration of individual goals and objectives. It’s like finishing a marathon and being asked to run it again, immediately, for double the prize.

2) Do investors need to be part of that initial we-got-an-exit-offer conversation?

Selling your company is (usually) a once-in-a-life decision. So, as a startup founder, the first person, aside from your co-founder, that you should talk to when you receive an exit offer is your spouse/partner because your partner is the person you’re probably most aligned with when it comes to you and what you want to do with your life.

Before bringing in outside parties, founders must discuss and align their priorities internally. It’s more important to involve team members since they are the backbone of the business and will provide support if the decision is made to continue with the venture.

Investors will try to tell you that they are always aligned with you in the exit discussions. That’s not true. They will have different objectives and priorities depending on their entry point, fund size, overall fund performance and other factors. Investors are diversified while you only have one company & one shot.

You should involve investors only once your desire to exit is crystal clear.

As an investor myself, I will always say that if the founder makes money, everybody else makes money. And when that time comes, then that is the time. Investors should then help push the deal towards a successful outcome for everyone.

3) What should be the investors’ role?

When the founders agree and decide they want to pursue an exit, that’s when investors should go out and try to connect with these potential buyers through their networks. Having investors involved in the conversation at that point can bring valuable perspectives and expertise to the table, which can help the founders make a more informed decision. It’s important to carefully evaluate each offer and consider all the factors involved, such as the potential for future growth, the financial benefits of the offer, and the impact on the company’s employees and customers. Investors should focus on helping with negotiating deal terms, doing DD on the acquirer and guiding founders through the process.

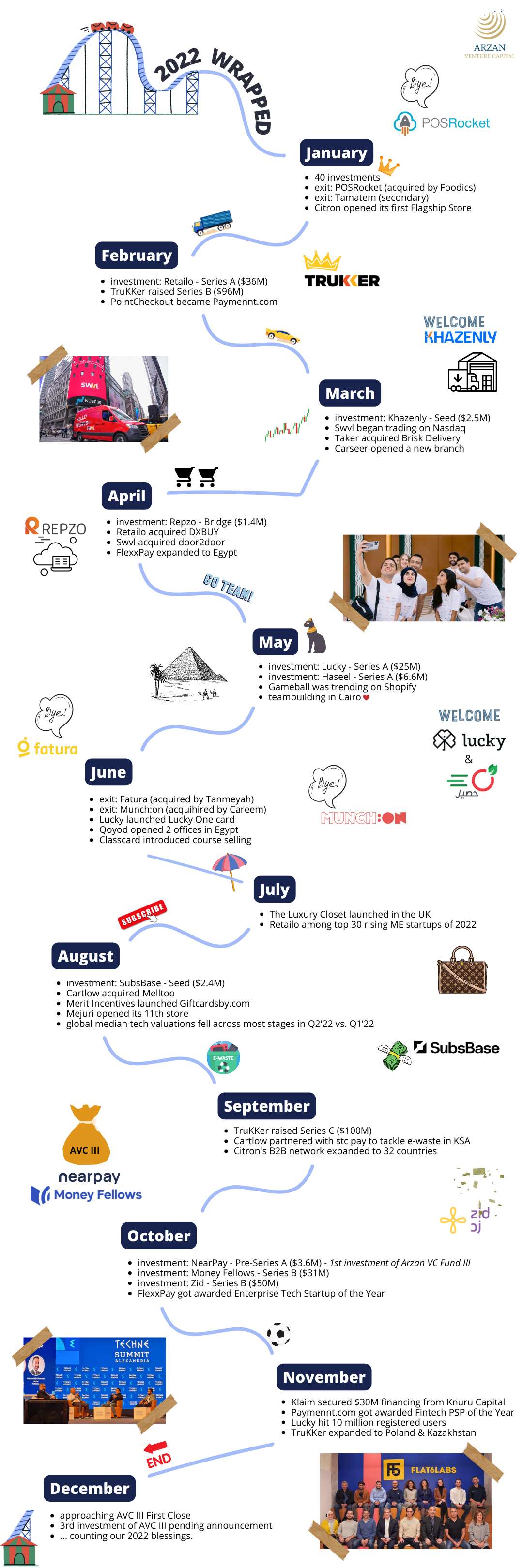

There is a good example of a portfolio company of ours that decided to sell “early”. We felt it wasn’t the right decision, but we supported it anyway. This was just before the global financial conditions took a turn in 2022. We’re now thankful they took that exit. Interestingly enough, that company was in Egypt. Phew!

As investors, we are there to support the founders in their journey from start to exit and help them maneuver it – as long as the founders know what they want to do. We shouldn’t provide an answer to the question of whether to exit or not; only guidance and advice once that decision has been made.

—

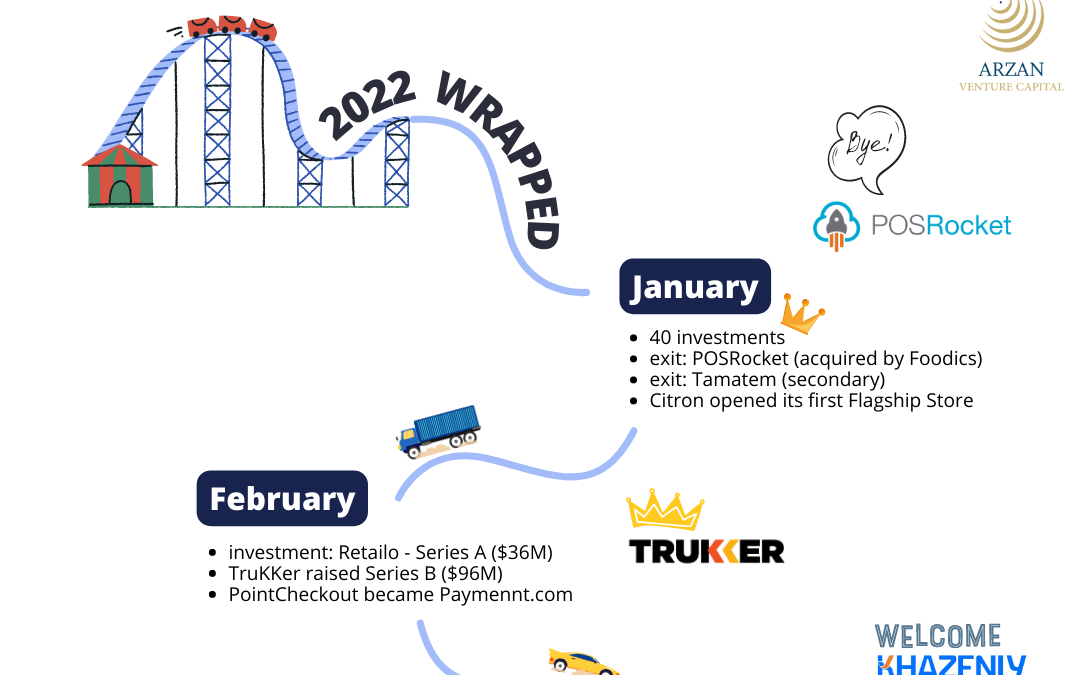

My co-panelists were Zeid Husban (founder of POSRocket – acquired by Foodics), Sameh Saleh (founder of Hawaya – acquired by Match Group) and Bassem Raafat (Principal at A15), and we were moderated by Qusai AlSaif (CEO & MD of Sadu Capital). It was a fired-up one!🔥

|

TL;DR (too long; didn’t read)

Laith talks about the mistakes that founders should avoid when they receive an exit offer, who they should speak to first and what's the role of investors. Remember that investors will try to tell you that they are always aligned with you in exit discussions - which is not true - with the exception of a rare breed of investors that will give you the right advice regardless of their own interest.

|

Outliers

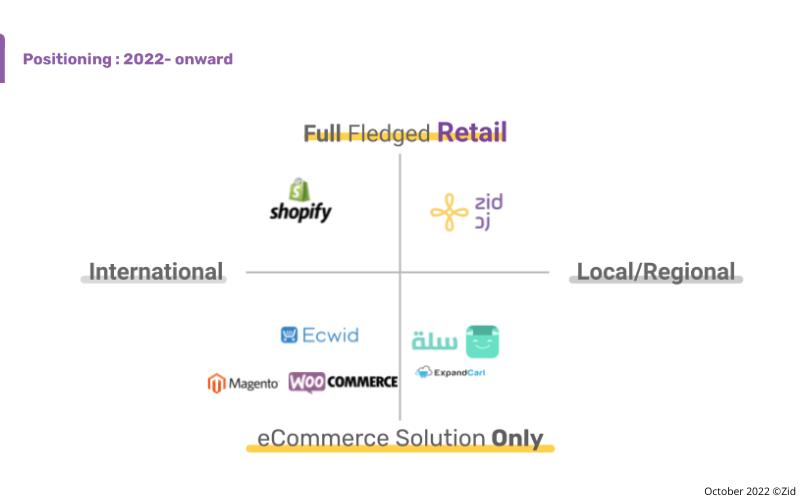

Zid and Money Fellows are part of Endeavour Outliers list of companies for 2023 = top ~9% out of ~2,500 companies.

Moved to Riyadh

As part of the first joiners for the RELOCATE Initiative: Move to Saudi Arabia, Merit relocated its regional HQ to Riyadh. Also, Merit’s founder Julie Barbier-Leblan became President of Incentive Marketing Association IMA MEAPAC.

+1 partnership

Klaim partnered up with Dubai Healthcare City to help healthcare providers manage insurance claims and cashflow.

Fashion innovator

The Luxury Closet was featured in the Khaleej Times’ wknd. magazine as an innovator in the fashion resale market.

+1 article about us: “MENA-based investors with the highest portfolio exits” by Magnitt (note: we made more than 7 exits; Magnitt doesn’t count secondaries)

- Legal Associate at Retailo (Karachi)

- Operations Onboarding (Back Office) at Zid (Riyadh)

- Sales Executive (Outbound) at Zid (Jeddah)

- Senior Graphic Designer at Lucky (Giza)

- Graphic Designer at Cartlow (Cairo)

- Quality & Authenticity Assistant – Luxury Watches at The Luxury Closet (Dubai)

- UX Copy Writer at Money Fellows (Cairo)

Blessed Eid! 🌙

Hasan

P.S. 1 wish: Can MENA banks become more startup-friendly?

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter, too.

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2023 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list