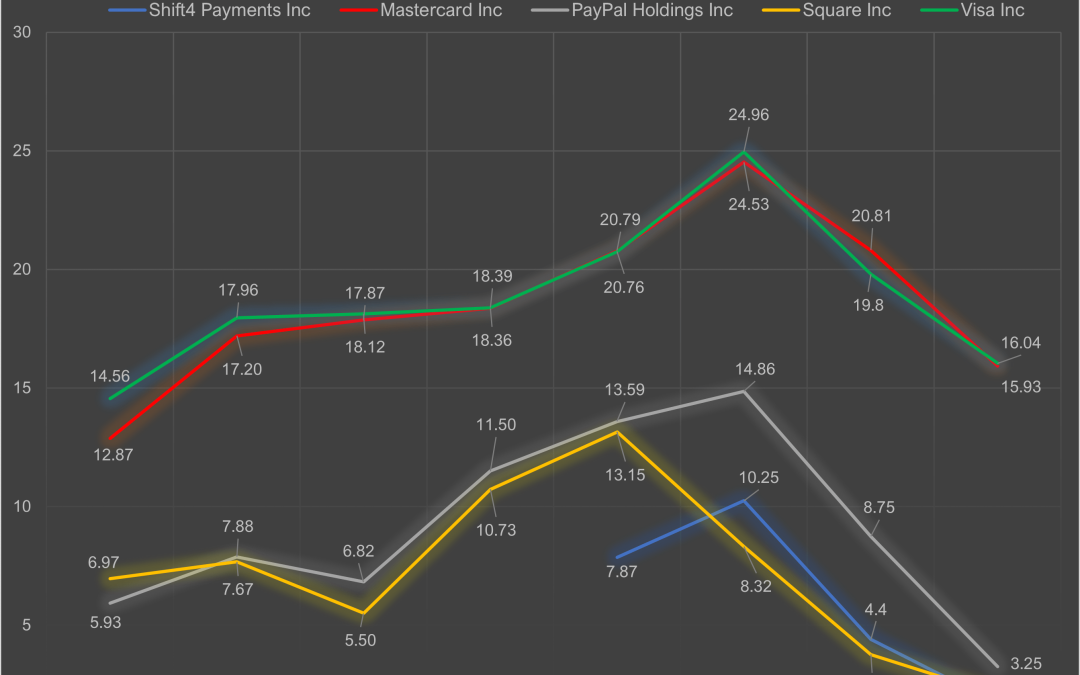

4 graphs to show you why regional tech valuations remain unrealistic

My team – namely Asia and Noha – did a mighty job reviewing public multiples (EV-to-Revenue) and their recent journeys across different sectors. In the next step, they compared these public multiples to multiples of their private counterparts in the region. The results speak for themselves. And because sharing is caring, here I am serving you the research.

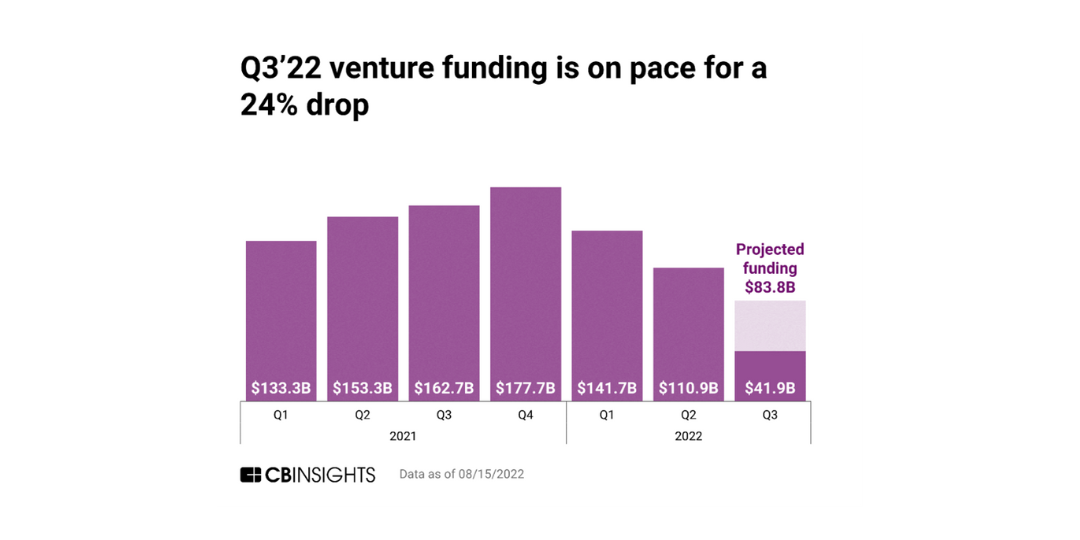

I wrote in the last newsletter that “median tech valuations fell across most stages in Q2’22 vs. Q1’22” and that “the valuations reset is bound to continue”. The graphs presented here reflect on that fall.

So much room to ungrow

We track a total of 100+ publicly listed companies that match the sectorial make-up of our region. Fintechs, CRMs, F&Bs, e-commerces, transport co’s, etc. We follow their QoQ ups & downs in terms of EV-to-Revenue multiples. Tracking public multiples is a daily bread for a VC like us. It provides us with a clearer idea on whether the valuations of private companies (in the region) are too high or reasonable. Well, you can guess… I must say some valuations we’re seeing these days have already become more realistic, but there is plenty room to grow (or rather… ungrow).

I’ll start with public multiples and their trajectories since the end of 2018 until mid-2022 – that is, including pre-covid, covid, post-covid, energy crisis… the full menu. (Small note: these public multiples are based on TTM revenue.)

Graph 1 – examples of selected public companies in the fintech space. Their trajectories are creating beautiful parallels, except for Square’s peak that happened 6 months ahead of the rest. Note that, as of June’22, only Mastercard and Visa were still above their pre-December’18 levels, while Shift4 Payments, PayPal and Square were already below those levels. We will look out for the numbers as of September’22 to see whether the plunge will continue or finally stabilize…

Graph 2 – examples of selected public companies in CRM and CX spheres. In contrast with the above fintech graph, the trajectories here are not so parallel. Shopify was on a plateau from June’20 till June’21 before taking a nose-dive. HubSpot followed the curve of fintechs, while Salesforce.com and IBEX Holdings were rather consistent. One thing clear; the reset is on.

Next, I present a median public multiple per specific vertical and multiples of startups (labeled A, B, C…) that are active in the given vertical. Note: because definitions may be too wide or overlapping, the presented median doesn’t include all available public multiples for the given sector (e.g. fintech), but it is the median multiple of only those public companies whose activities are the same as of the showcased startups… The selection pool may seem small to you, but that’s because each graph is showing only a specific vertical. Also note: the data on private multiples is limited (of course).

The showcased startups (A, B, C…) are homegrown in the MENA region and the graphs below serve to demonstrate the discrepancies between multiples and the available “room to ungrow” when it comes to valuations of MENA startups. Startup multiples are calculated based on revenue (last month annualized) and latest round valuation (LRV).

Graph 3 – the median public multiple (5.3x) represents multiples of Square, Fawry, PayPal, Visa, Mastercard, Affirm and Zip Co*. Only one startup in the exhibit (startup A) had a revenue multiple lower than the median public multiple (4x). This suggests that at least half of the analyzed fintech startups has valuations that could require corrections in the near future. It should be noted that several fintech startups raising at the moment have minimal or no revenue and we have not included those in the above graph (because then it would look scarier and it’s not Halloween yet).

Graph 4 – the median public multiple (6.01x) represents multiples of Salesforce.com Inc, IBEX Holdings Ltd and Shopify Inc*. Only one startup in the exhibit (startup A) had a revenue multiple lower than the median public multiple (4.56x). So, we can assume that majority of the region’s CRM/CX startups out there are overvalued. No breaking news here.

Next time you’re negotiating a valuation, be mindful of the above. Don’t bandwagon and jump onto deals as this may one day result in a real damage to our regional ecosystem. The valuation reset is likely to continue in the coming quarters if the energy crisis deepened further. Well, winter is coming…

* Like I explained earlier, this is a selection of public companies that best matches the vertical of the showcased startups in the given graph.

|

TL;DR (too long; didn’t read)

Public multiples are nose-diving and tech valuations are still higher than 2020, but not for long? We analyze 100+ publicly listed companies and track the life of their EV-to-Revenue multiples since December’18 to see where it’s all heading. Down. Then we compare the Q2’22 public multiples with some selected startups in the region (we focus on fintech and CRM/CX). High, high, high, very high revenue multiples. Overvalued. Startups.

|

263% of minimum goal raised

GoPillar launched its crowdfunding campaign on Republic as the startup aims to further revolutionize the architectural design market. Contribute here.

Studying Citron

INSEAD published a case study on Citron entitled “Global Expansion of a Consumer Goods Start-up from the Middle East”.

e-waste in Saudi

Cartlow partnered with stc pay to boost the circular economy in the Kingdom. Cartlow will empower the KSA consumers to eliminate e-waste by selling their devices on the platform whilst earning stc pay credit.

+1 photo

Here’s Laith’s souvenir from his visit to Tunisia, where he attended AfricArena North Africa Summit 2022.

- (different roles) at Retailo (UAE, KSA)

- (different roles) at TruKKer (UAE, KSA)

- Partnerships Marketing Executive at Khazenly (Cairo)

- Public Relations Manager at Lucky (Cairo)

- Senior Graphic Designer at Citron (Dubai)

- Senior Sales Executive – Outdoor at Zid (Riyadh)

- Marketplace Manager at Cartlow (Riyadh)

- Software Engineer (ROR) at Qoyod (Cairo)

See you at GITEX and RiseUp Riyadh… and possibly elsewhere 😉

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter too.

Received this from a kind friend? You can subscribe to our newsletter too.

Copyright © 2022 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list