faking confidence vs. faking numbers

Pardon my French but this one’s a good entrée:

“As an industry we’ve become experts at content marketing the shit out of our wins, the shiniest versions of what venture and startups can be.” (Hunter Walk)

Content marketing remains a powerful weapon, but I feel like “the shiniest versions” are no longer welcome. Real > Shiniest. No more of that unhealthy FITYMI (= fake it till you make it).

Spoiler alert: You don’t have to fake it to make it.

A guide for those who don’t want to fake it until they make it (to prison, sometimes)

I’m sure each one of us knows at least one FITYMI story. Remember Elizabeth Holmes and the Theranos saga? That’s an extreme case of course; her FITYMI didn’t quite work and Holmes’ fraud cost her 9+ years behind bars. But it shows how far FITYMI strategy can take us…

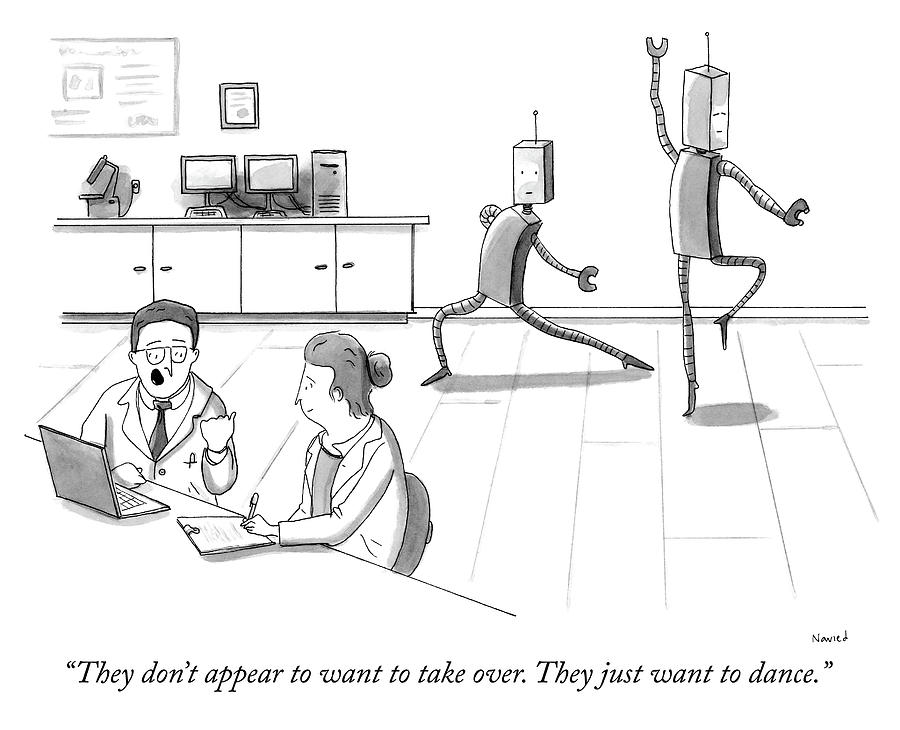

Fake it until you make it is a way of life in which a person shows themselves as a success before they become one… They’re faking the confidence they need to get to where they want to get. That’s relatively healthy, until it isn’t. Often they end up faking much more than confidence: tech prowess, product viability, numbers, even customers…

I’m not saying you can’t get away with faking, but I feel like those who fake it almost always cross ethical lines… and the ecosystem became really cautious about “the shiniest versions”, the exaggerations and the overshot Moon landings. On the other hand, professional investors should make the effort to poke through the unreal façade created by certain founders. Posing specific, in-depth questions will reveal the founders’ true knowledge, put things in the right perspective and bring everyone safely back on Earth before any casualties may occur.

It’s clear to everyone that the bar for success is being continuously raised – because we’re maturing up.

So how can you make it without resorting to faking it?

The following steps may seem to you like a very repetitive preaching, but with the amount of pitch emails the team keeps receiving, I think we still need to do some more preaching:

1. CAN I SOLVE IT LIKE NO ONE ELSE? Don’t rebrand an existing solution. Yes, it usually takes an effort to find unique problems out there. Seek an “a-ha” moment. And once you find it – ask yourself: Can I solve it like no one else in the market? Yes? What are the barriers to entry for someone else? Can my unique solution transform into a unicorn? If you don’t have a strategy on how to deliver us the moon, then you shouldn’t promise it.

2. YOUR TEAM SHOULD BE SMARTER THAN YOU.

3. BUILD A TEAM BASED ON ACHIEVING MILESTONES IN YOUR OVERALL STRATEGY. Avoid recruiting a full-fledged team when you have no traction or validation.

4. SHOW US THAT YOU AIM TO MAKE REAL MONEY and not just burn it. Can you be profitable? When? What kind of customers will pay you? Can you win them over? How?

5. DO YOU KNOW WHAT YOUR BEST MARKETING STRATEGY IS? Your customers. They are never “just” your revenues and profits.

6. OPTIMIZE FOR THE NEXT STEP. Work today on optimizing for tomorrow. Like in business, like in life.

7. NURTURE HEALTHY CONFIDENCE.

The same applies to VC funds. I believe there’s no room for faking things and misleading. I also believe in showing all your cards to your investors. Are you scared to tell them about your little red flag? They’ll most probably find out about it anyway… and by then it could grow into a big red flag. So why not tell them from the start? Transparency breeds trust. While it may not be easy to inform your investors about a setback you’ve encountered, once they are aware that you’re addressing it and being honest about it, they will not only support you but also develop a deeper respect for you.

Imagine you’re consistently feeding your LPs with overvalued portfolio data and then one day one of the investments collapses. “Oh, it was only 6% of the fund size…” True. But it was much more of your TVPI, wasn’t it? This one failure ate up a big slice of the TVPI cake.

Transparency > eye-candy numbers. For startups and VCs alike. So that each one of us can enjoy the cake.

|

TL;DR (too long; didn’t read)

While faking confidence to get to where you want to get can be relatively healthy, you can be easily tempted to fake much more: your tech prowess, numbers, you-name-it. Luckily for you, you don’t have to fake it to make it - and I tell you 7 ways how you can do that, including Solve it like no one else, Build a team that's smarter than you and Nurture healthy confidence... Also: Transparency > eye-candy numbers. For startups and VCs alike.

|

From us to you…. Our summer

Who’s the people’s choice? Money Fellows.

Retailo & Hala got WIRED

Subsbase put on a new coat

The road to an IPO

- Software Engineer (Ruby on Rails) at Qoyod (Riyadh)

- Machine Learning Engineer at Carseer (Amman)

- Head of Growth at Money Fellows (Cairo)

- Credit Collections / AR Specialist at TruKKer (Riyadh)

- Junior Accountant at Cartlow (Cairo)

- Last Mile Coordinator at Khazenly (Zamalek)

See you next week at Reflect Festival in Cyprus. Αντίο! (read: Adío!)

Hasan

![]()

![]()

![]()

![]()

![]()

![]()

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2023 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list

?

?

… How can founders win exits?

… How can founders win exits?