The startup ecosystem beyond army checkpoints

It’s all about tech startups in Palestine this month. A very dynamic ecosystem that’s growing in the shadows of its neighbors. Rewriting the headlines out there. Did you know they have quite a strong healthtech and agritech base?

Palestinian tech startups 101

Youth unemployment in Palestine will likely peak at 50% in this year’s PCBS census. That’s half of Palestinian youth (18-29y) being jobless. Many of them are university graduates who usually don’t have any other choice but to start their own business and become self-employed. Luckily, there’re quite a few support programs, catalysts and incubators available to entrepreneurs who need help to start off. But, as we know, there’s never enough of such support.

What’s remarkable about the Palestinian startup ecosystem is its large presence of highly educated, young founders and high proportion of female founders in particular. It’s also quite fragmented (geographically) and this impacts the interactions among players. A recent report states there are no more than 300 tech startups, another source says 50, while our research discovered 73 active tech startups. These discrepancies portray the dynamics and volatility of the market.

The local ecosystem has been growing in the shadow of its neighbors (or sometimes merely surviving). At least virtual ideas know no physical army checkpoints that daily restrain most of the local businesses, their owners and staff. (Although, before 2018, there was no 3G service, which slowed down even the virtual advances.)

Yet the recent outbreak of violence shook the already fragile foundations of the local startup scene. Many businesses lost offices, equipment… and the most valuable: staff.

International institutions have pledged support to reconstruct Gaza’s infrastructure and continue building the local digital economy. This includes a $30-million grant from the World Bank.

Due to financial and import-export difficulties and restrictions, most Palestinian startups must work with what they have at hands: solutions, infrastructure and funds. Some say it’s still the best to get funds from Triple Fs: friends, family and fools. Well, it’s time to add new letters.

Since most local startups provide solutions to everyday needs, they are not able to focus on business opportunities that lay beyond. Covid-19 helped boost the local e-commerce and pushed many businesses to start offering online deliveries for groceries and electronic appliances for the first time. It’s a win-win for both retailers and consumers thanks to the rising internet and social media usage.

A great number of the 73 active tech startups addresses healthcare issues – be it through telemedicine (Tebfact, Tanaffas), appointment booking system (Doctor On Time), prevention of chronic diseases (Wikaya, Dawsat) or cancer treatment technology (SynergyMed).

Startups focused on agriculture, environment and energy are fairly abundant, too. We came across businesses providing a solar energy system for housing (SunBox), clean water (Mayet Al Ahel, Blue Filter), fertilizers created from CO2 emissions (Greeners), water networks monitoring (Flowless), the first plantable plastic in the world (WhiteSapphire) and enviro-friendly construction materials (Greencake). Plus, in April, 23 green startups from Palestine were selected by GIMED (a “Green Impact” program for the Mediterranean region initiated by EU) to receive training and assistance. Bravo!

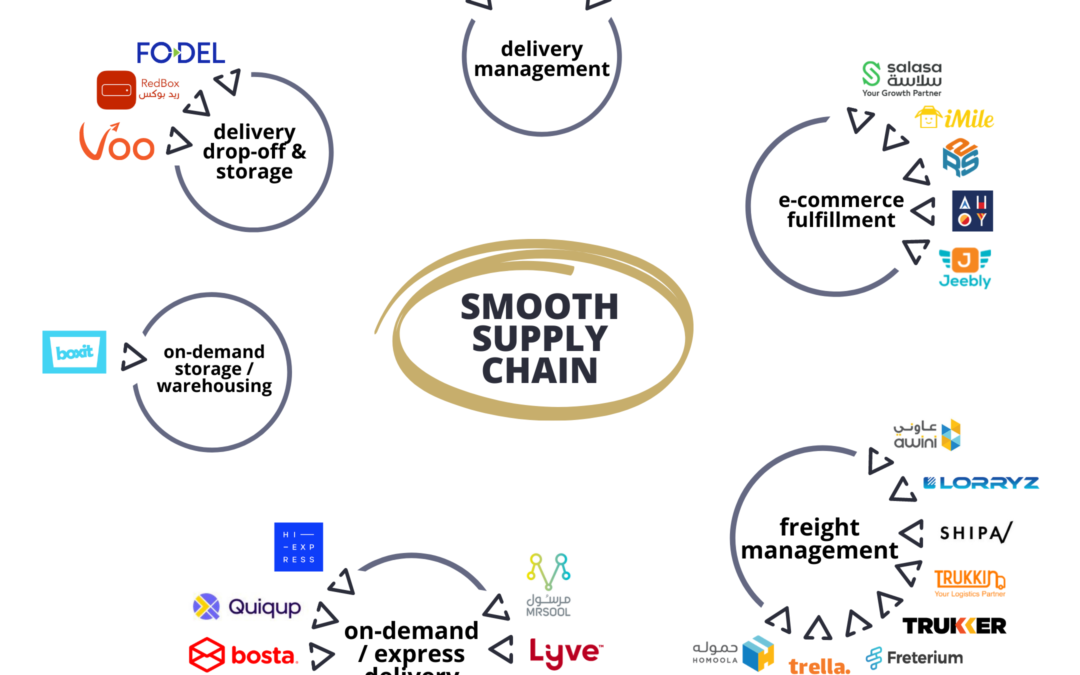

Areas that hold great potential for growth are supply chain & logistics, transport and edtech.

Years ago, the founder of lingerie e-commerce Kenz Christina Ganim said that there’s a new startup on the scene every month because Palestinians don’t want to read only headlines saying “Another new attack” but also “This Palestinian who succeeded”. More so now, in 2021.

What the local startup scene needs is:

- Better mentorship

- Greater support & capacity-building for the young talent

- Stronger tech infrastructure

- Increased early-stage funding (early-stage funding reached only $10,960 per startup in 2017-H12019)

- The ability to secure offices in other nearby countries to ensure stable operations in tough times. This entails government support in different logistical matters.

In our research, Palestinian tech startups cover businesses founded in Palestine and/or businesses founded by Palestinian entrepreneurs and operating in Palestine.

|

TL;DR (too long; didn’t read)

We discovered 73 active tech startups in Palestine, but the numbers vary since the ecosystem is very dynamic. Many startups fail due to lack of early-stage funds, infrastructure and mentorship. A handful thrives, especially in healthtech, agritech, e-commerce and services. Potential lies in supply chain & logistics, transport and edtech.

|

Starring on CB Insights

FlexxPay appeared in CB Insights’ State Of Fintech Q1’21 Report. (And so did we 😎)

It was a feat indeed

Retailo spoke to Bloomberg Asharq Business اقتصاد الشرق about their founding achievements.

Conferencing in Dubai

CarSeer participated in the 3rd International Insurance Conference InsureTek Middle East 2021 held in Dubai.

Whatsapping with clients

Need to improve your WhatsApp communication with customers? Zid will tell you how.

Reverse is the way forward

Cartlow writes about reverse logistics in June’s issue of Logistics News ME.

🧘

Stress management tips by Classcard.

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter too.

Received this from a kind friend? You can subscribe to our newsletter too.

Copyright © 2021 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list