2023 vintage may be the best one of the decade, but will it be clean enough?… friendly enough to our environment?

Although cleantech is already on the region’s radar and already helping counter & prevent environmental damages and climate change in the region. I will tell you which verticals show room for growth.

A clean slice is served below.

Cleantech 2.0 meets MENA

Could the future major cleantechs come from the Middle East? Yes.

Achieving energy efficiency is no longer a luxury. It’s a necessity. Especially in our region – one of the most vulnerable ones in the world when it comes to the impact of climate change. Water scarcity, rapidly increasing waste levels, uneven access to reliable electricity, food insecurity from the agricultural point of view… But – who knew that one day the cheapest energy on our planet would come from the Middle East? (Solar, not oil.)

The next great disruption in MENA could be about access to clean, affordable energy and clean water. And good clean things are well underway. Back in 2016, Morocco had 28 renewable energy mega projects – the most in the region at that time. Much changed ever since – and more so in GCC:

Saudi Arabia pledged to implement a 50% renewable energy mix by 2030 and achieve net zero carbon emissions by 2060. NEOM aims to run on 100% renewable energy. Just few days ago Saudi Arabia’s Regional Voluntary Carbon Market Company announced plans to launch a carbon credit trading exchange in early 2024, and the kingdom’s Ministry of Investment has also signed a $5.6 billion deal with Chinese electric car maker Human Horizons. And the Strategy of Resolve that Saudi Arabia embarked on together with UAE is another milestone. The newly established UAE Carbon Alliance aims to support the transition of companies to a green economy, as set out in the UAE Net Zero by 2050 Strategic Initiative. And the Emirates recently announced a project for solar-plus-desalination plants. Qatar is not lagging behind; its carbon-neutral 2022 FIFA World Cup is just the tip of the clean-berg. The country’s Minister of Environment and Climate Change recently inaugurated the Environmental Pioneers initiative, although Qatar Airways’ CEO sounded doubtful about the aviation industry achieving net-zero emissions by 2050. Bahrain, GCC’s smallest oil producer, aims to double renewable energy targets to achieve 20% of the total energy mix by 2035. Interestingly, Bahrain’s F1 Grand Prix 2023 was the circuit’s most sustainable race ever with all circuit usage for F1 being covered by clean energy. When they say hydrogen, think of Oman, because it plans to become a competitive low-emissions hydrogen supplier by 2030 with 1 million tons produced annually, and 8.5 million tons by 2050 (which would be more than total hydrogen demand in Europe today). They also aim to phase out all fossil fuel powered vehicles by 2050. And then there’s Kuwait which has set out to achieve carbon neutrality in O&G by 2050, with 15% of renewable energy within its energy mix by 2030. It has also unveiled plans for XZero City, a sustainable net-zero community for 100,000 residents in the south of Kuwait.

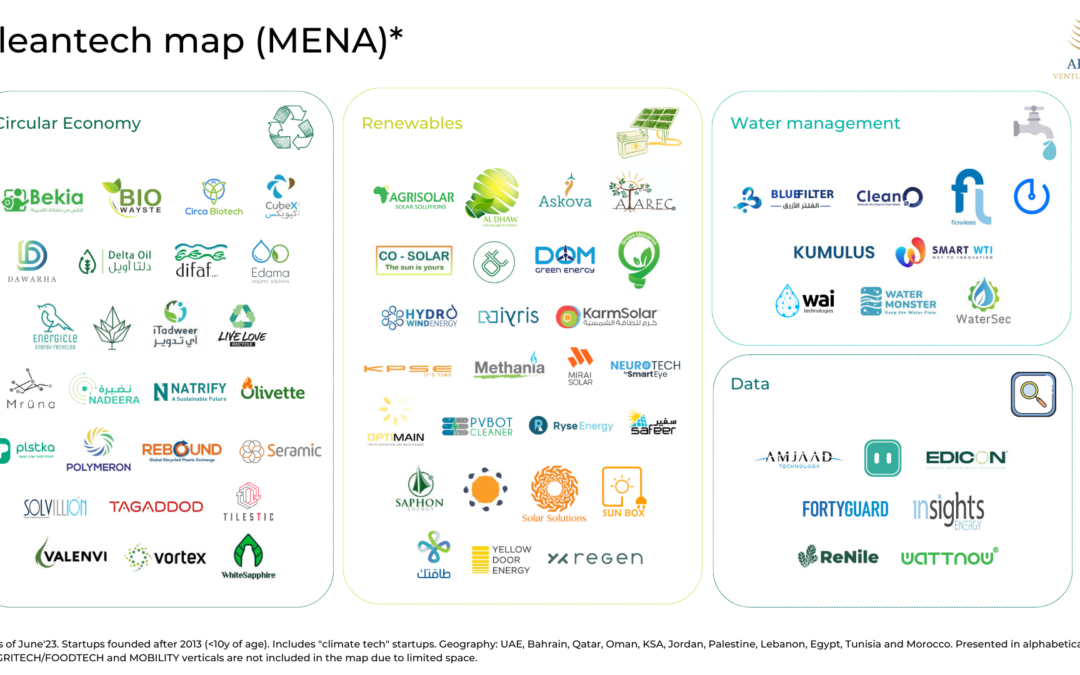

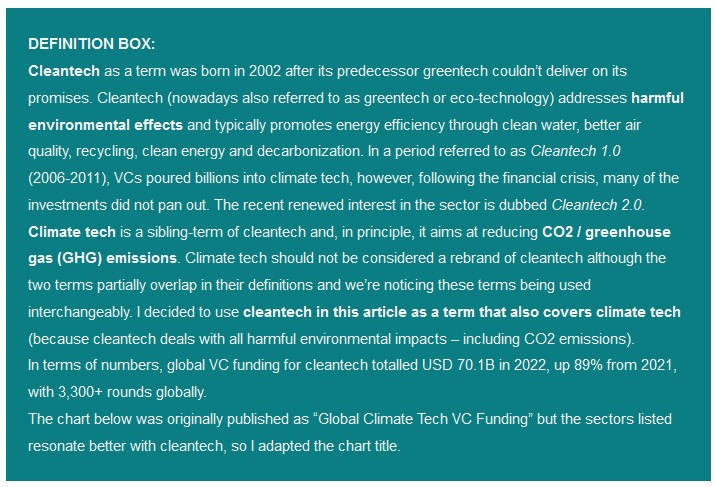

Let’s talk about the local ecosystem. I analysed 104 cleantech startups in total and most of them are active in circular economy (waste) and renewables (mainly solar and some wind). In terms of geography, a quarter of the pool is based in Egypt, followed by UAE (15%) and Lebanon (14%). Have a look:

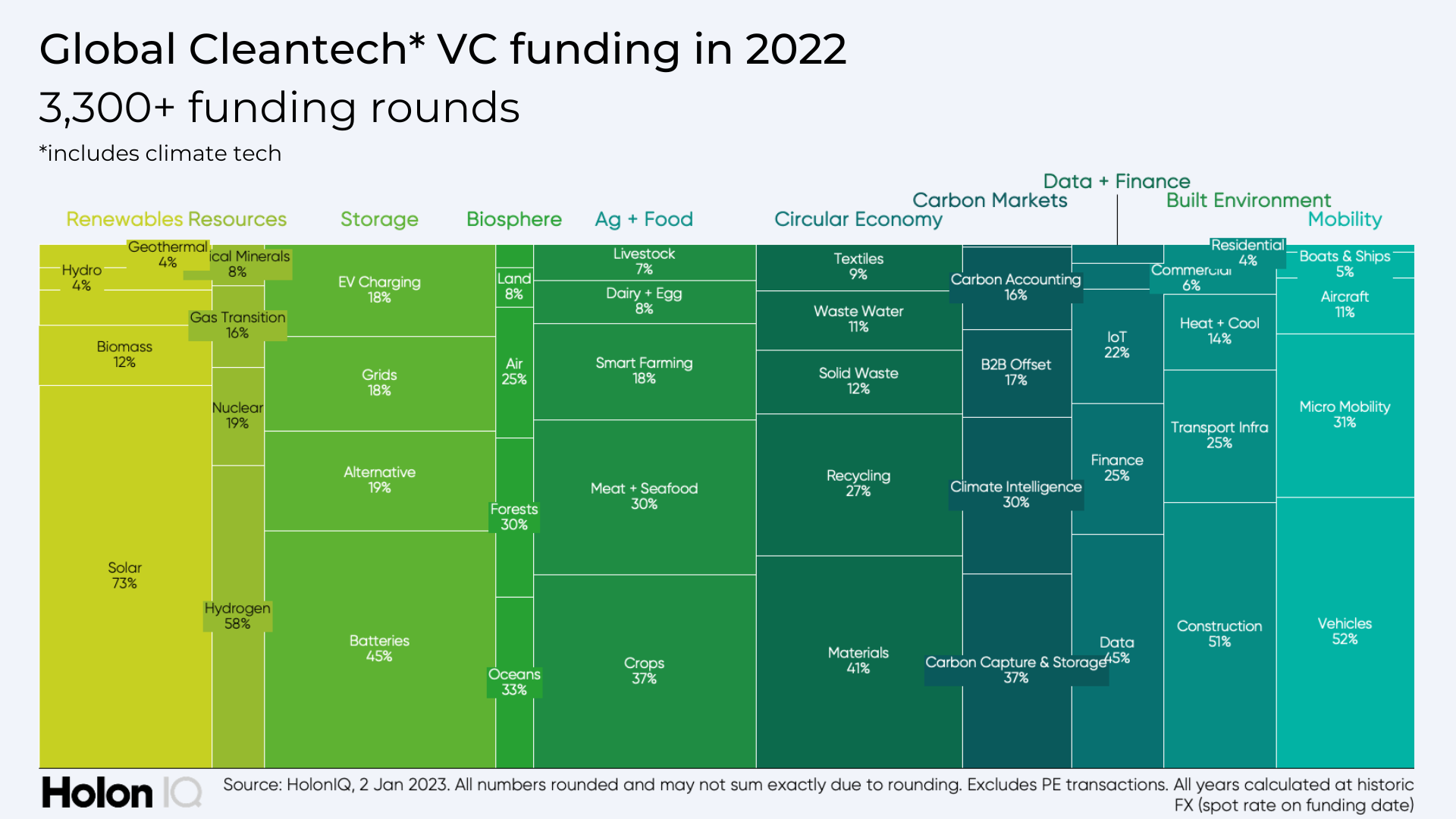

ROOM FOR GROWTH: Energy storage and decarbonization show much room for growth, while resources (hydrogen), built environment (construction) and energy storage remain largely untapped.

By now we all know that cleantech investments can be profitable. For communities and for investors alike. As far as Arzan VC goes, I’ll be blunt and say that we don’t have a clear-cut cleantech investment strategy, but we have already invested in cleantech via our Fund II. For example, Cartlow (UAE) is a re-commerce platform which tackles the environmental damage caused by e-waste.

Here’s to the Cartlows of tomorrow. We need you.

|

TL;DR (too long; didn’t read)

Access to clean energy and clean water could well be the next great disruption in MENA. Work is already underway in the GCC to achieve net-zero emission targets. I analyzed 104 cleantech startups, out of which most are active in circular economy (waste) and renewables. A quarter of the pool is based in Egypt, followed by UAE (15%) and Lebanon (14%). Verticals like energy storage, decarbonization, resources (hydrogen), built environment (construction) and energy storage show much room for growth.

|

- VP of Technology and Product at Klaim (Dubai)

- Scrum Master at Money Fellows (Cairo)

- Business Development Specialist at TruKKer (Jeddah)

- Junior Accountant at Khazenly (Cairo)

- Account Manager (Americas) at Merit Incentives (remote)

Happy vacations.

Hasan

![]()

![]()

![]()

![]()

![]()

![]()

Received this from a kind friend? You can subscribe to our newsletter, too.

Copyright © 2023 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list