Today’s menu: Great returns & some effective ESG on the side

It’s a longer read today (and no, don’t skip this email). I’ll discuss the adoption of Environmental, Social and Governance (ESG) standards by regional tech startups and how VCs could be the gamechangers in this important matter.

November has been exciting for us so far; iKcon got acquired by REEF and our family welcomed two new members: Merit Incentives and our new analyst Noha El Sherif. 😎

What if we consider ESG a bit more…

A very fresh report on GCC consumers exposed that their biggest worry is illegal data collection and misuse. And while the public is becoming more socially and environmentally conscious, we as VC investors should take that into account when analysing potential investments.

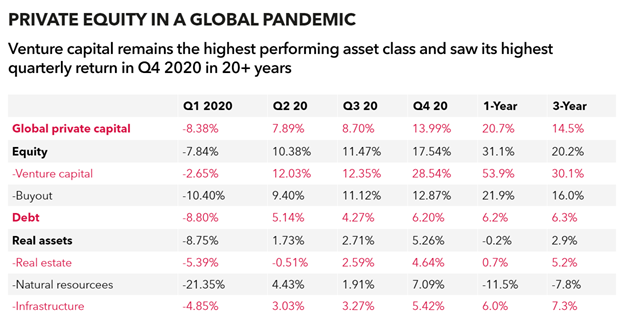

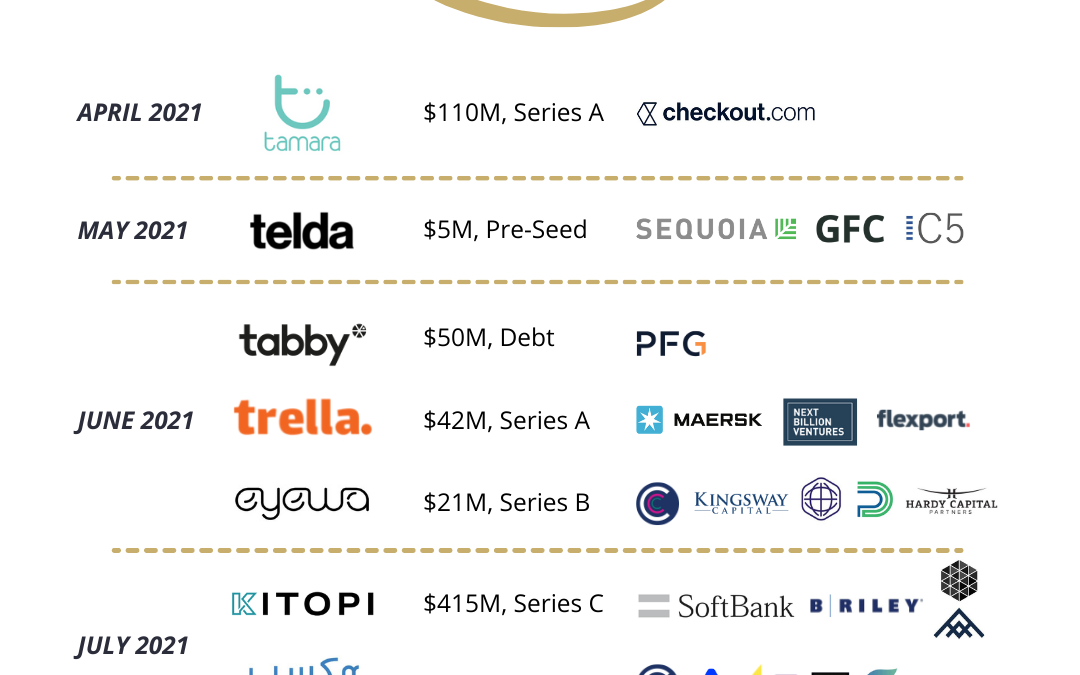

Mentions of “ESG” during earnings calls have skyrocketed since mid-2020. Could the same be said of calls between LPs and fund managers and the latter and startup founders? What we can say with certainty is that ESG principles are gradually shaping LPs’ preferences and fund managers’ investment choices. Because ESG isn’t an exclusive playground for multinational corporations; SMEs and startups need to play along, too. As usual, the Middle Eastern ecosystem is catching up.

My analysis will be 2-fold:

1. Regional tech startups adopting ESG

2. Can VCs help startups get their ESG right?

Regional tech startups adopting ESG

Each sector comes with its own set of associated ESG risks. An agritech startup would have a different ESG strategy than a ride-hailing app and so on.

Here’s my adaptation of ESG principles for startups (note that it’s not definite):

Having good ESG standards in place can provide a startup with these outcomes:

– Attracting more investments

– Attracting talent & retaining it

– Improved brand image

– Lower risks (market risks, reputation, etc.)

– Long-term sustainability

Here are some local startups that are taking ESG very seriously:

– Swvl: Congestion reduced by 14.4 million person-hours. 245 million pounds of CO2 emissions saved. That’s what Swvl accomplished in the last 4 years―since its inception. The startup recently shared its 2021 ESG Report “Right to Mobility” – and we are very happy they did so. It’s important that startup stars like Swvl pave the way for other startups to pen down and execute their own ESG strategies.

– Cartlow: This startup has sustainability at its core and its re-commerce platform has already helped reduce a lot of e-waste and boosted environmental sustainability.

– Mejuri: The fine jewelry e-commerce aims to trace each of its pieces from mine to market to manage and improve the social and environmental impacts of its supply chain. Mejuri’s sustainability goal is to reach 100% traceability of materials. By the end of 2021, 100% of 14k gold products will be 100% traceable, with 70% being certified recycled and 30% responsibly mined.

– TruKKer: Its carriers can save their empty miles by up to 13%, which reduces carbon emissions. Multiple deliveries can be clubbed into a single booking, increasing productivity by up to 20%, saving time, fuel and trucks’ service life.

Can VCs help startups get their ESG right?

Middle East Investor Relations Association (MEIRA) believes that the majority of the market here really cares about ESG and is working off the same hymn sheet to drive progress. Do regional VCs care as well? Yes, some already do. We at Arzan VC agree that ESG is an important factor to be considered and it positively affects businesses in the long run.

One of my takeaways from the Future Investment Initiative in Riyadh is that local startups lack a framework for implementing ESG policies. ESG becomes important when a company reaches scale, however basic ESG can be implemented from Day 1. VCs can be gamechangers in this regard. Integrating ESG into our own investment analyses would allow us to introduce the concept to startups. How?

– Looking for ESG when evaluating a startup is like looking for an additional value―not monetary but just as important. During due diligence, we analyze the main environmental and social trends affecting the startup’s geo region and industry and then we place the startup right into that analysis, highlighting its opportunities and risks. This analysis could serve as a good starting point for the introduction of ESG principles into that startup. VCs thus have a unique position to help create ESG-conscious businesses. Plus, when it comes to early-stage startups, these don’t have extra financial/human resources to allocate to ESG, so this is an added value that VCs can offer.

– We can compare the startup to its competitor (at a regional level) and create a sectorial ESG benchmark, i.e. having a single metric for each startup industry.

– Crunchbase argues for a simpler, single metric for all startups in a VC portfolio; a single metric for “E”, “S” and “G”, that is. In terms of the Environment, it could be a metric related to climate change, e.g. emissions. The Social indicator could be team diversity and inclusiveness. The Governance metric could be the percentage of independent directors on a startup board. Lastly, the startup founders should identify which of UN Sustainable Development Goals they enable and track their impact.

CB Insights was asking in one of their July newsletters about startups providing ESG ratings for private startups. That’s to say, there aren’t many. Such startups would be active in AI and alternative data domains. We got one like that in our portfolio: Crowd Analyzer. It’s not ESG-focused per se, but it can be of great help when analyzing the social sentiments on social media. Like how people feel about the activities of that and that company and what its brand reputation is like.

There’s a chance that ESG could become the future of investor confidence―for the regional startups and VCs alike. So, what if we start considering ESG a bit more and make it part of our DD… food for thought.

|

TL;DR (too long; didn’t read)

The region's public is becoming more socially and environmentally conscious, and so are LPs, VCs and startups. I introduced an adaptation of ESGs for startups and named a few that are working hard on their ESG sustainability, one of them being Swvl. I also suggested how VCs can help nurture ESG standards in their startups and that there is a lack of startups providing ESG ratings for other startups.

|

Next stop: Hong Kong

Citron expanded to a new market, Hong Kong, where it will be able to access additional 2.65 million families. Where to next?

Saudi fintech map

Qoyod got featured among the leading Business Tools & Information Provision in the latest Saudi Fintech Map 2021. Well-deserved, guys!

Zid & Qoyod at Step Saudi

Zid’s Co-founder & CEO Sultan AlAsmi as well as Qoyod’s Founder & CEO Abdullah AlDayel will be participating in “The Rise of B2B marketplace in Saudi Arabia” panel at Step Saudi (Nov 17-18).

Best workplaces

MUNCH:ON has been awarded one of the Best Places to Work 2021 in Pakistan. Careem is on the list, too.

- Junior HR Consultant at WizHRD (remote)

- Business Analyst at Zid (Riyadh)

- Customer Success Executive at Gameball

- Senior & Junior Talent Acquisition Specialists at Fatura (Cairo)

- Sales Executive KSA at FlexxPay (Riyadh)

- Sr Front End Engineer at Qoyod (Cairo)

Take care!

Hasan

![]()

![]()

![]()

![]()

![]()

![]() Received this from a kind friend? You can subscribe to our newsletter too.

Received this from a kind friend? You can subscribe to our newsletter too.

Copyright © 2021 ArzanVC, All rights reserved.

Want to change how you receive these emails?

You can update your preferences or unsubscribe from this list